Read this article in French German Italian Portuguese Spanish

ERA/IRN RentalTracker: Pressure in the present, future rebound?

16 July 2025

More than 110 equipment rental companies across Europe participated in the ERA/IRN RentalTracker survey for Q2 2025. Lewis Tyler reviews the main takeaways.

The latest ERA/IRN RentalTracker suggests that business sentiment across Europe’s rental industry has taken a step back from the modest positivity at the end of last year. While not a collapse by any means, signs of strain are emerging.

The Q2 2025 survey, conducted during June and early July, attracted responses from more than 110 rental businesses across the region.

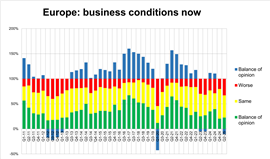

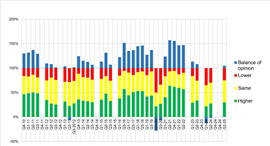

These responses reveal a mixed picture: 23% of companies reported improved market conditions, while 33% said conditions are worse.

With 44% indicating no change, the result is a negative balance of opinion of -10%, marking a downturn from the +10% balance recorded in Q4 2024.

This shift likely reflects ongoing pressure from high interest rates and sluggish construction activity in several countries.

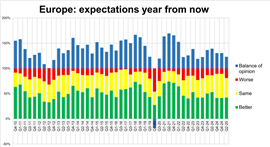

On the positive side of the coin, the number of companies expecting business to improve within 12 months has risen to 42%, with just 19% forecasting deterioration, giving a strong balance of opinion of +23%.

That’s slightly down from +30% in the Q4 2024 survey, but still represents a confident outlook from much of the industry.

This “forward-looking optimism” has become something of a theme in recent surveys. While companies are under pressure now, many expect, or hope for recovery by mid-2026.

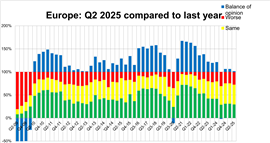

This sentiment is also reflected in year-on-year comparisons. When asked about Q2 2025 activity levels versus the same period in 2024, 27% of respondents reported higher levels, while 22% said activity was down.

The resulting +5% balance, though modest, suggests some resilience in core rental demand despite broader economic headwinds.

Utilisation and CapEx

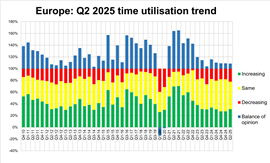

Utilisation — the metric that reflects how much of a fleet is actively being used — has remained relatively stable across Europe.

Overall, 31% of respondents reported increased utilisation in Q2 2025, compared to 22% who reported a decline. That gives a positive balance of +9%, consistent with the same figure recorded in Q4 2024.

The strongest utilisation figures once again come from Spain, where 85% of companies reported an increase. However, a lower number of responses here means this should be taken as anecdotal.

Italy follows with 43%, and Germany also posted a positive trend with 27% noting rising utilisation, a substantial improvement from just 7% one year ago.

France (26%) and the UK & Ireland (15%) showed weaker numbers, with the latter seeing a decline from 21% last year. Multinational firms reported a utilisation increase of 33%, suggesting that larger companies may be benefiting from greater flexibility across markets.

As for CapEx, although the appetite for fleet investment has not disappeared entirely, it has become more selective and uneven.

10% of companies expect to increase fleet spending in 2026. Yet, with almost as many planning to hold back or reduce expenditure, this points to a cautious approach in the face of economic uncertainties.

Italy and multinationals lead the way on investment intentions, with 50% of respondents planning to increase spend next year.

Germany, which had recorded only 8% positive CapEx sentiment in the last survey, has rebounded to 38%, suggesting that the market may be slowly regaining confidence.

Spain, by contrast, shows a marked drop, with only 38% expecting to invest more, compared to 66% in the previous year.

This could be a sign that Spanish rental firms, after a period of strong growth, are beginning to consolidate rather than expand.

France remains at the bottom of the investment chart, with just 13% of companies indicating they will increase spending — a marginal increase from 10% but still very low by historical standards.

These figures suggest that while some companies are continuing to invest in fleet renewal, many are holding off on major commitments until clearer market signals emerge.

Elsewhere, employment plans offer some grounds for caution. 30% of respondents across Europe anticipate expanding their workforce by Q4 2025, a modest decline from 39% last year.

Geographical breakdown

Zooming in at a country level reveals significant differences in sentiment across Europe. Once again, Spain stands out for its confidence and strong growth indicators. At the end of Q2 2025, 87% of Spanish respondents reported improving market conditions, up from 69% in the same quarter last year. It also tops the charts for year-on-year growth (87%) and utilisation (85%).

While sentiment remains lower overall, 42% of respondents in Italy reported growth versus Q2 2024 (up from 29%), and 30% said market conditions had improved. This is a positive shift, even if tempered by ongoing market uncertainty.

In the UK and Ireland, the picture is more restrained. Only 27% reported improving conditions (a slight increase from 24% last year), while 33% reported growth year on year.

Germany shows modest improvement compared to last year’s numbers, but remains subdued. Just 20% report improved conditions, up from 6% last year. Quarter-on-quarter growth was noted by 22%, also a rise from 6%, but still below the European average.

France continues to post the weakest scores of any major market. Just 5% of respondents said they were experiencing improving conditions — a marginal increase from zero in Q4 2024.

Only 26% saw year-on-year growth, and just 13% intend to increase investment in 2026, suggesting a sector still under significant strain.

Multinational companies recorded more conservative sentiment overall, with only 8% reporting year-on-year growth and 36% citing better current conditions. However, expectations for 2026 investment and hiring remain stronger than those of many single-country operators.

Food for thought

So, the results of the Q2 2025 ERA/IRN RentalTracker paint a picture of a sector navigating uncertainty with a combination of pragmatism and forward-looking optimism.

The balance of sentiment has clearly slipped compared to the end of 2024, but expectations for recovery remain intact in many areas.

Utilisation levels are encouraging and serve as a reminder that core rental demand has not evaporated, even if conditions are not yet strong enough to drive confidence.

As ever, the industry seems to be keeping one eye on present pressures and the other on future opportunities.

Notes:

The full report, with more data, will be published in the July-August issue of International Rental News.

The survey was conducted in June 2025 and the first two weeks of July 2025, with more than 110 companies in Europe taking part. IRN would like to thank ERA and national rental associations in Europe for their help in distributing the survey.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM