The opportunities and the challenges of a data centre building boom

08 May 2024

AI-fuelled demand for new data centres in the USA, Europe and Asia Pacific promises to be one of the key drivers of construction growth in 2024 and 2025. But with more and more countries placing restrictions on these power-hungry buildings, locations, designs and even power sources are changing rapidly. Neil Gerrard and Lucy Barnard report.

Driving through London’s Docklands, the great grey windowless shape of East India Dock House stands as a testimony to changing technology.

Once humming with the crackle and whir of the printing of thousands of pink copies of the UK’s Financial Times newspaper, these days the building instead has become one of London’s main data centres, humming with the sound of row upon row of computer servers blinking eerily amid the roar of air conditioning units.

The 250,000 sq ft data centre, now known rather anonymously as London North, was first opened in 1999 by data centre developer Global Switch in an attempt to encourage firms to move their computer servers off site to the hi-tech facility and soon filled up.

Data centre interior. Source: Adobe Stock

Data centre interior. Source: Adobe Stock

By 2002, Global Switch had launched the 750,000 sq ft purpose-built London East across the road in Docklands to cope with even more demand from cloud hosting and social media.

Now, 20 years later, the company is expanding again, this time to a 290,000 sq ft purpose-built facility known as London South to cope with an even greater surge in demand as corporate customers demand ever more powerful storage solutions to run their artificial intelligence (AI) and high-performance computing (HPC) systems.

Certainly, every video uploaded, social media post or crypto token traded adds to the growing piles of global data produced each year. According to US-based International Data Group, around 129 trillion gigabytes of data were generated in 2023 and that figure will double over the next two years.

This massive growth in data is fuelling ever greater demand for data centres like London North, where power demands are compounded by chillers working hard to counter the incredible amounts of heat produced by energy-intensive racks of servers so that the hardware won’t deteriorate.

AI fuels data centre demand

And, as businesses and consumers become more reliant on large language models such as Chat GPT and other AI tools which require massive amounts of training data to refine their algorithms, that demand is set to explode even further – and with it the demand for contractors able to build and fit out these specialist buildings.

Charlie Bater, director of data centres at UK-based construction specialist Black & White Engineering, is witnessing this phenomenal growth first hand.

Samhwa’s Immersion Cooling system, a refrigeration system for computers that submerges the device in cooling liquid showcased at the Mobile World Congress 2024 in Barcelona, Spain. Photo by Joan Cros/NurPhoto via Reuters

Samhwa’s Immersion Cooling system, a refrigeration system for computers that submerges the device in cooling liquid showcased at the Mobile World Congress 2024 in Barcelona, Spain. Photo by Joan Cros/NurPhoto via Reuters

“My first project, which was maybe seven years ago now was five megawatts, and at the time that was a good-sized project. Now a good-sized data centre building is 60, 70, perhaps a hundred megawatts of capacity. The scale has just grown immensely,” he says. “The big question at the moment is what is AI going to do to the market? Typically cloud service provider demands have been increasing but AI is power hungry. It has the potential to push those megawatt numbers even further.”

According to Dublin-based consultancy Linesight, demand for new data centres in the USA, Europe and Asia Pacific is set to be one of the key drivers of construction growth across all three regions in both 2024 and 2025, buoying up an industry which has been hit hard by global interest rate rises and spiralling materials inflation.

In the USA, which is home to the world’s biggest number of data centres, Linesight says that the pipeline for new data centre projects currently stands at US$160 billion, with approximately a fifth of that pipeline located in the state of Virginia. However, it adds that Atlanta, Dallas, Ohio and Portland are witnessing sustained demand growth while cities like Phoenix are reaching capacity. New markets specialising in AI and machine learning are emerging in Indiana, Minnesota, Alabama, Wisconsin and Nevada and several data centre providers are even expanding to remote locations in search of cheap land and a plentiful power supply.

Where are most data centres being built?

“The US data centre market in particular is booming as operators rush to accommodate the rise of AI, with total capacity, rack density and energy consumption all set to increase substantially,” says Patrick Ryan, Linesight’s executive vice president for the Americas. “Several data centre providers are expanding beyond densely populated and popular cloud markets to remote locations where land and power resources are more abundant in anticipation of future AI deployments.”

In Europe, too, Linesight says that, despite a subdued macroeconomic outlook, which is likely to lead to a contraction in overall construction outlook in 2024, demand for data centres, as well as hi-tech industrial buildings, manufacturing and infrastructure is expected to remain high with London the city with the most projects under execution, followed by Germany, France and Ireland.

Worker in data centre. Source: Adobe Stock

Worker in data centre. Source: Adobe Stock

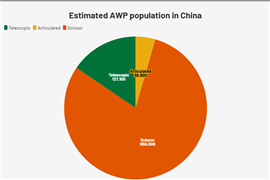

And Linesight says a surge in e-commerce, 5G expansion and widespread adoption of cloud computing and AI are helping to make the Asia Pacific region, covering Asia, Australia and the Middle East, one of the fastest growing data centre regions in the world. It said growth centred in China, Australia, Japan and Singapore but there was growing interest in emerging markets such as India, Taiwan, Malaysia and Indonesia.

But construction experts point out that supplying the increasing demand for data centres is far from straightforward – especially when it comes to providing the massive amounts of power each one consumes. London North and London East together have been reported to draw as much electricity from the UK grid as the entire domestic requirement as the city of Glasgow.

“What we’re finding is that basically any data centre development at the moment is power restricted,” says Black & White’s Bater. “If you don’t have a big power connection, you don’t have a project. In the core busy markets, power is becoming more and more finite. Developers are reaching out to tier two or tier three markets – so from Frankfurt we look to Berlin, from Berlin to Munich – just because we keep running out of power in regions.”

In some countries this is becoming a serious issue. In Ireland, which currently hosts 82 data centres, state owned utility company Eirgrid says that data centres now use as much electricity as the country’s entire domestic housing stock. To allay concerns about the capacity of its grid, the company has said it will not connect them up until 2028.

More efficient cooling and new power sources needed

Singapore too has been facing similar issues. In 2019, the city-state imposed a moratorium on building new data centres due to their high power consumption which it only ended in 2022 when it became one of the first countries to impose strict energy efficiency requirements based around a power usage effectiveness (PUE) cap on any new data centre applications. In 2023 Germany followed suit passing its own PUE cap and the EU is also in the process of introducing similar legislation.

Data centre owners and developers are looking to meet the double demands for both more power and greater efficiency by turning to cutting-edge cooling systems. These can include: immersion cooling where components are submerged in a bath of non-conductive liquid; direct to chip solutions which pass cooling liquid through plates at the points where computer components get hottest; or rear door heat exchangers, which use radiator-like doors filled with cool liquid mounted on the back of server racks for cooling.

“What we typically see is eight to 12 kilowatts per cabinet but for AI what we’ll probably start seeing is 45 kilowatts on average or even a hundred kilowatts plus. You just can’t cool that with air as a medium. So, you need to move to some kind of cooling system,” Bater says. “But it’s tricky in terms of design because if you’re a property developer you need to still design something that you can sell now – but you can’t use that as a default base because you would exclude the traditional market base of cloud service providers which use air cooling so designs have to be adaptable to both.”

Although data centre buildings themselves are unlikely to change much in future, remaining mostly built on site using steel and concrete slabs, increasingly data centre developers are attempting to secure their own dedicated power sources for their power-hungry buildings.

Architectural rendering of Oklo’s Aurora powerhouse nuclear power plant. Image: Gensler

Architectural rendering of Oklo’s Aurora powerhouse nuclear power plant. Image: Gensler

In the US last year, Google signed a 150MW power purchase agreement with Danish energy giant Ørsted to buy power from its Helena Wind Farm in Texas for the next 15 years. Others are following suit including US-based Equinix which signed seven windpower offtake agreements in February with German renewables developer WPD for wind farms to be built in France.

Others still are looking towards nuclear power. US-data centre giant Equinix is reported to have recently signed a pre-agreement with Small Modular Reactor (SMR) firm Oklo to procure up to 500MW of nuclear energy to its facilities. In 2023 US-based power producer Talen Energy Corporation announced it had it had created the world’s first nuclear powered data centre at its Cumulus datacentre campus, built on land it owned adjacent to its Susquehana nuclear generation facility outside Berwick, Pennsylvania. In March 2024, Amazon acquired the 960MW campus in a US$650m deal.

“To keep up with this insatiable demand data centres will have to start moving away from the traditional grid operation. But the question of what will replace it is not an easy question to answer,” says Bater. “Gas is difficult because it’s not carbon-friendly; hydrogen is not a good answer because you’ve got to make the hydrogen and then get it to the site. There are a lot of people doing work on small nuclear reactors but the problem with SMRs is that data centres get some objection from planning and permitting as it is - but wait until you want to put a nuclear reactor in someone’s back yard. We need an answer - and that seems to be the biggest driver of change.”

|

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM