RentalTracker survey: Europe’s equipment rental sector shows signs of life

08 April 2024

How is Europe’s rental sector performing at the start of 2024, and what is the feeling for the coming year? Murray Pollok reports on the findings of the ERA/IRN RentalTracker survey for the first quarter of 2024.

There is just enough positive news in the Q1 RentalTracker survey to justify our ‘Signs of life’ headline. Expectation levels for 12 months ahead are rising, and include a likely increase in fleet investment next year; time utilisation levels seemed to be shifting up year-on-year in the first quarter of the year; and current business conditions (at the end of March) showed an improvement on the two previous surveys in 2023.

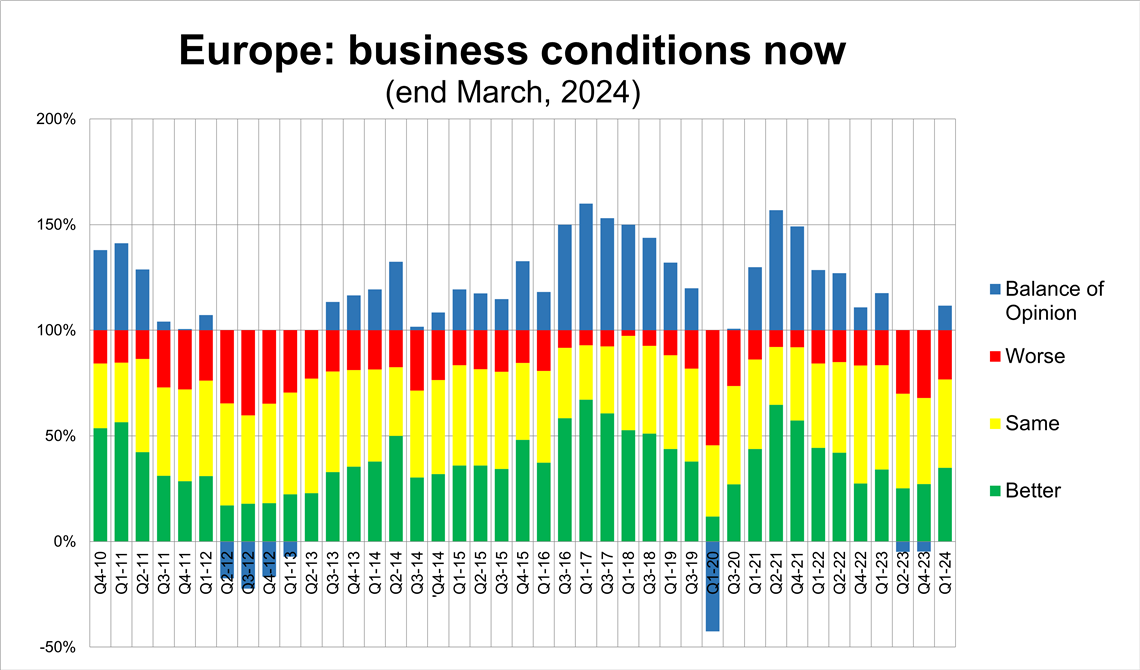

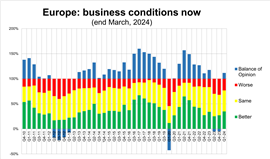

Business conditions now in Europe’s equipment rental sector, as surveyed at the end of March 2024. (Graph: IRN)

Business conditions now in Europe’s equipment rental sector, as surveyed at the end of March 2024. (Graph: IRN)

There are some positive signs, then, but a fuller picture of the survey results would acknowledge that rental companies may be looking forward to 2025, but they still have the rest of 2024 to get through first. (The level of participation in the survey - 130 responses - was the highest since early 2021 and tells of an industry keenly interested in its current trajectory.)

Looking first at ‘business conditions now’, there was a positive balance of opinion of +12% (that is, the difference between the proportions experiencing positive (35%) and negative (23%) conditions). That is the first positive result since the Q1 survey in 2023, but still low in the context of the results from 2021 and 2022.

Spain, Germany and the Benelux were the most positive regions here, while there was insufficient data from the UK and Italy to say anything meaningful. French rental companies were the least likely to report any positive current trend, and multinational businesses were not far behind.

The survey was carried out by International Rental News (IRN) and the European Rental Association (ERA) at the end of March and the first week of April, 2024.

Fleet utilisation trend

The trend on utilisation levels seems to confirm the modestly positive finding on business conditions at the end of March, with a positive balance of opinion on utilisation rates of +16%. That reverses the very low level of sentiment at the end of 2023 and returns the trend to the positive levels seen in the Q1 and Q2 surveys in 2023.

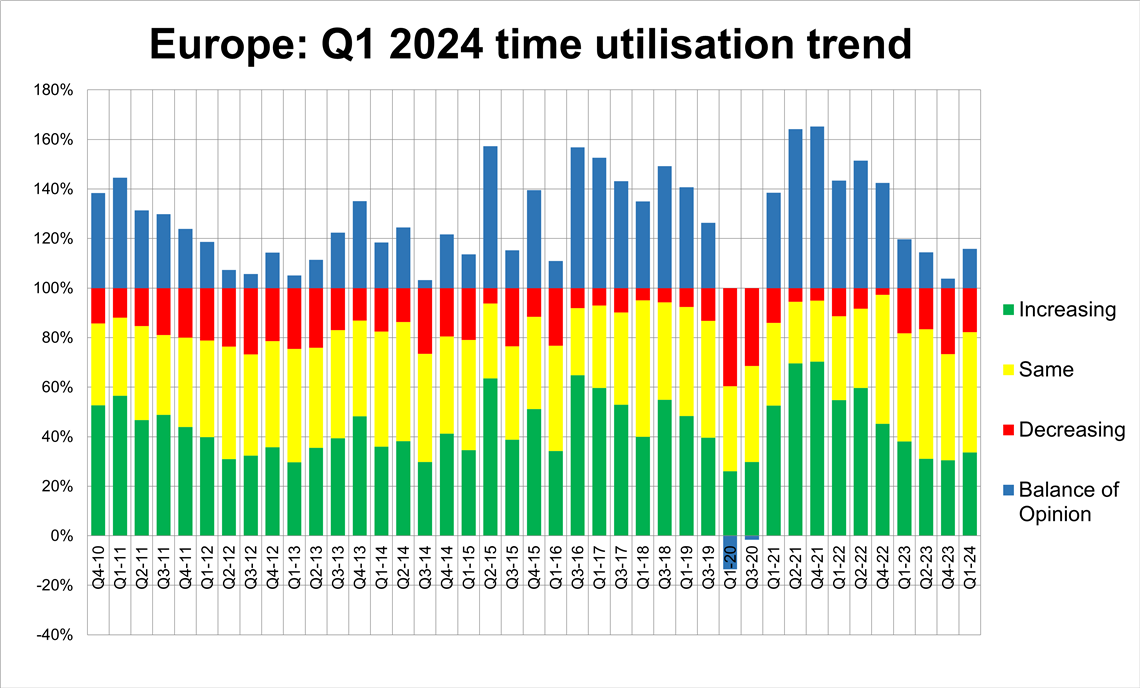

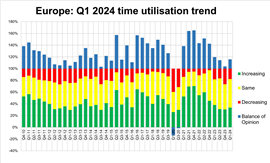

Fleet utilisation trend in Europe’s equipment rental market. (Graph: IRN)

Fleet utilisation trend in Europe’s equipment rental market. (Graph: IRN)

Just 18% of respondents reported declining fleet utilisation at the end of March this year, compared to the 34% who were seeing an increase, with almost half seeing no change.

Companies in Spain and Benelux were the most upbeat here, with those in Germany, France and multinationals less so.

In terms of levels of business activity in the first three months of 2024, there was a +21% positive balance of opinion, which was almost identical to the findings in the Q2 and Q4 surveys from last year. Business is not growing rapidly, but it is growing.

The post-Covid period was hectic in growth terms, so the slow but positive findings from the Q1 survey points to something like a return to normal, although at a significantly lower level than seen in the years immediately before and after the pandemic.

Spain and the Benelux were again above the European average in terms of Q1 year-on-year activity, with Germany, Multinationals and France all in the lower half of the table. It was French companies, again, at the bottom of the sentiment league.

Investment plans for 2024/2025

The weak economic backdrop, not to mention the ongoing wars in Ukraine and Gaza, have led rental companies to be more cautious on their levels of investment. Asked about their likely fleet spending levels in 2024, there was a negative balance of opinion of -13%.

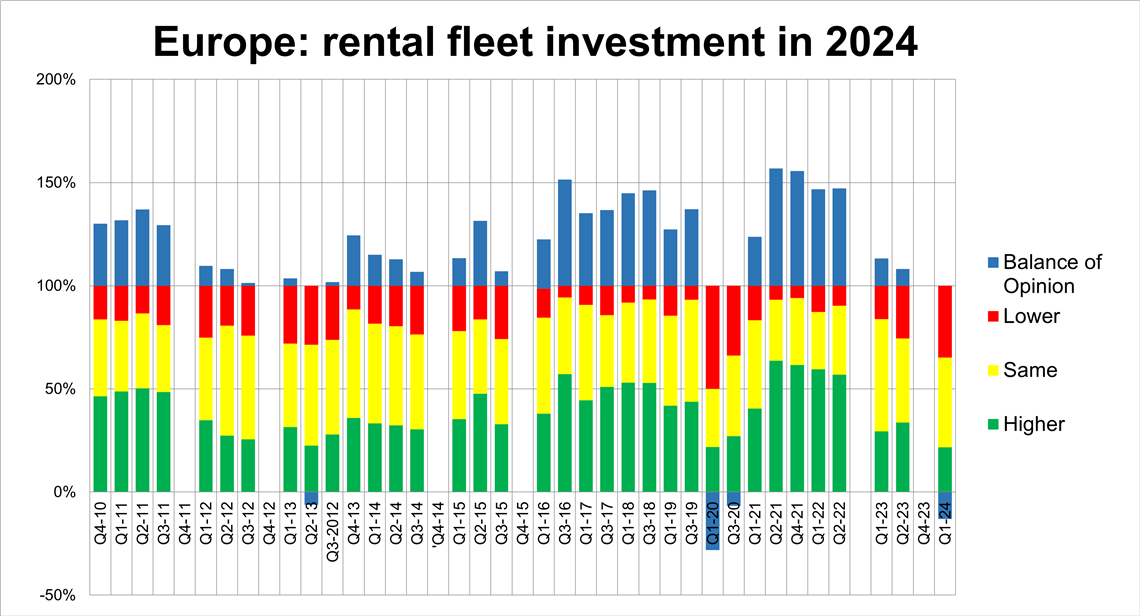

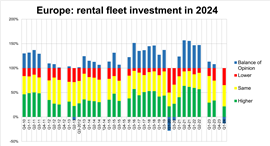

Fleet spending in Europe’s equipment rental sector in 2024. (Graph: IRN)

Fleet spending in Europe’s equipment rental sector in 2024. (Graph: IRN)

Around 80% of all respondents said spending would be the same or less as 2023. That sounds more negative that it actually is, because a large proportion, 43%, will maintain spending at 2023 levels and almost 22% will increase investment.

Still, for the first time since the start of the pandemic, more people say they will cut spending than increase it.

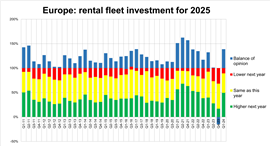

The sense that the industry is collectively waiting for 2025 is reinforced by the finding on forecast fleet spending next year, with a positive balance here of +39%. Fewer than 11% of respondents said they were likely to reduce investment in 2025. It seems it will be OEMs as well as rental companies looking forward to next year.

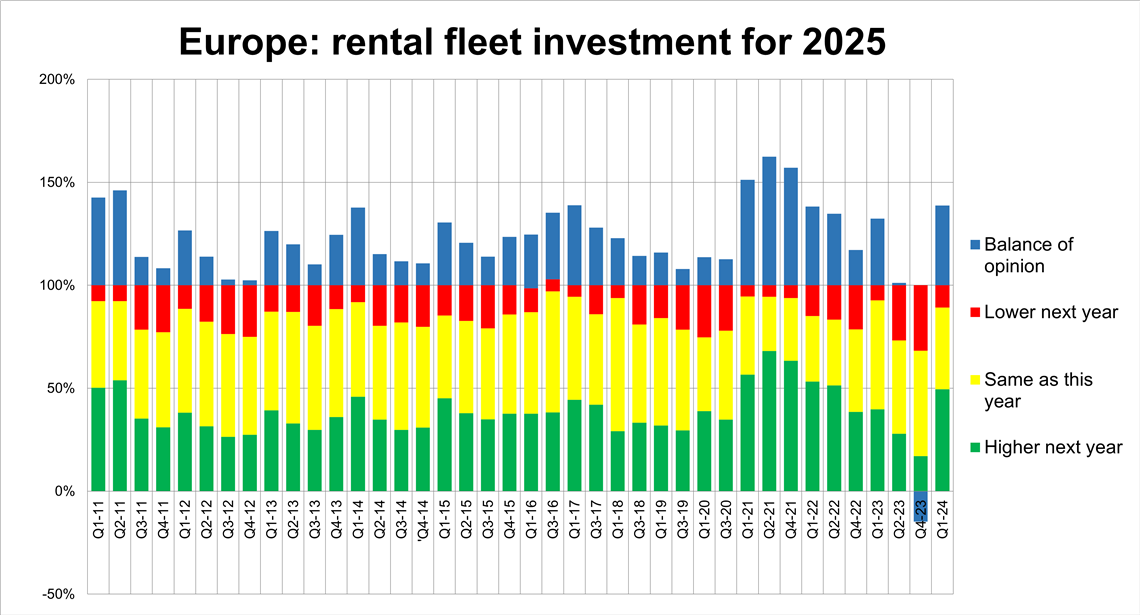

Forecast fleet spending in Europe’s equipment rental industry in 2025. (Graph: IRN)

Forecast fleet spending in Europe’s equipment rental industry in 2025. (Graph: IRN)

German and multinational companies were most likely to increase spending this year – both on small samples – but if the forecast intentions are acted on, then 2025 will see a big increase in investment by rental companies in France, Germany, the Benelux and by multinationals.

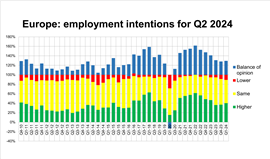

Recruiting intentions

Finally, we come to the employment intentions among rental companies. This measure would in normal times be a good reflection of business activity and forecast activity, but in today’s labour market, with companies finding it difficult to recruit staff, the findings are more complicated to read.

There is still a much larger proportion of businesses seeking to recruit more staff in the next quarter than reduce their headcounts, even in a period of economic uncertainty and generally lower investment levels. In France, for example, there is still a +35% positive balance of opinion on recruitment intentions, despite its more pessimistic findings elsewhere.

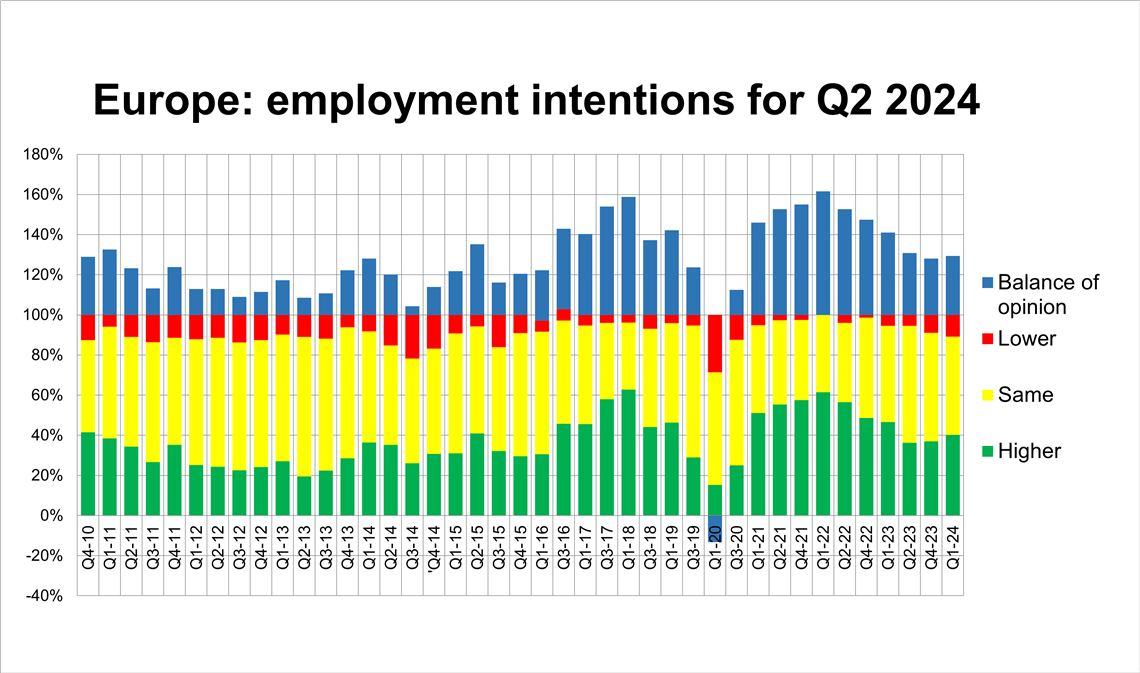

Recruitment trends in Europe’s equipment rental industry. (Graph: IRN)

Recruitment trends in Europe’s equipment rental industry. (Graph: IRN)

Overall, there is an almost +30% balance of opinion on recruitment intentions for Q2 2024, and it has remained at that level since the start of 2023. That reflects the challenges of finding and retaining staff, although on the plus side it represents a more stable situation that was facing the industry in the 2021 and 2022, when positive balances were frequently above 50%.

That recruitment and retention of staff is a key focus for rental companies can be seen also in the activities of the European Rental Association (ERA), with a new report and recommendations on the topic expected before the summer.

The start of 2024 finds the rental industry anticipating better times to come. They are not here quite yet.

Invitations to complete the ERA/IRN RentalTracker survey for the second quarter of 2024 are now open. Click here to complete the survey.

Notes:

The full report, with more data, will be published in the March-April issue of International Rental News.

The survey was conducted in the final week of March 2024 and first week of April 2024, with 130 companies in Europe taking part. IRN would like to thank ERA and national rental associations in Europe for their help in distributing the survey.

|

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM