Modular construction firm Katerra files for bankruptcy

09 June 2021

US technology-enabled construction company Katerra has filed for bankruptcy protection after struggling to cope with the “macroeconomic effects” of the Covid-19 pandemic and the “unexpected insolvency proceedings” of its former lender.

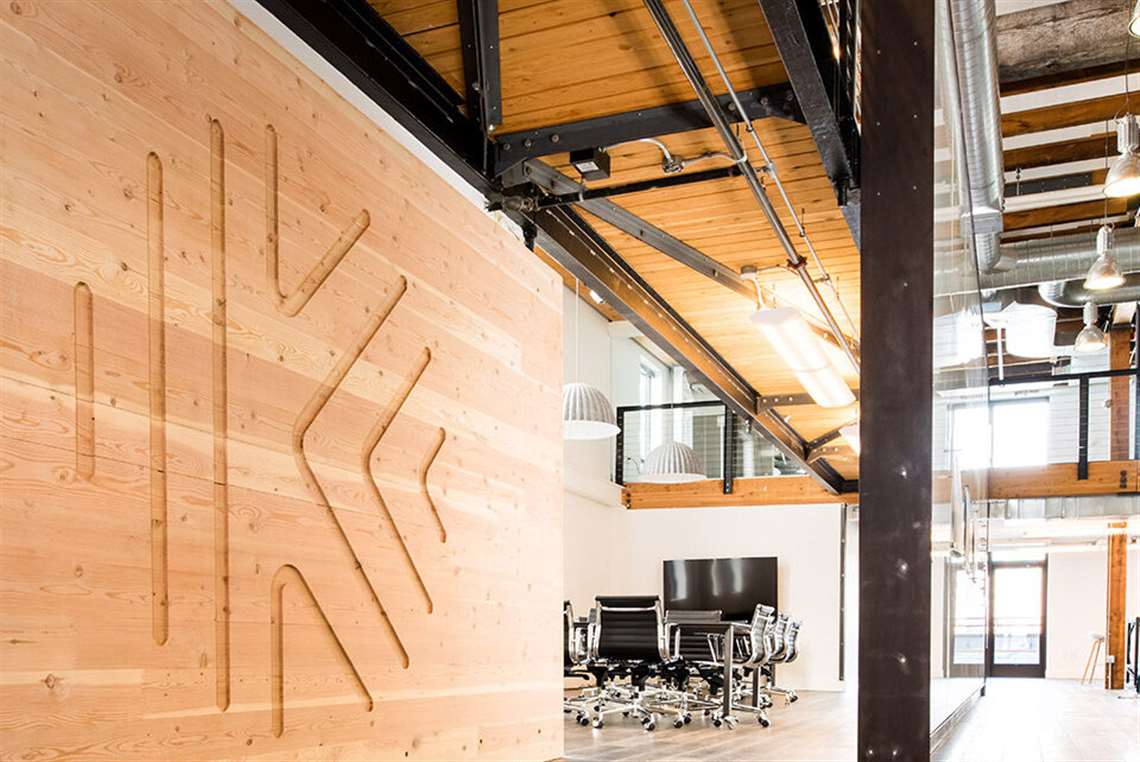

The California-based firm was established in 2015 with the ambition to “transform the construction industry” using a fully integrated approach to mass timber design, production, engineering, distribution and construction services.

The company promised to reduce the cost and complexity of large buildings by using prefabricated modular units.

However, the company said the “rapid deterioration” of its financial stability was the cumulative result of it being unable to secure both new business and additional funding, following the collapse of its lender.

With offices across North America, operations in China, India and the Middle East and around 8,000 employees globally, Katerra, “voluntarily filed for relief under Chapter 11 of the US Bankruptcy Code in the United States Bankruptcy Court for the Southern District of Texas”, in order to help protect itself.

Marc Liebman, chief transformation officer, said, “While a number of negative factors have led to Katerra’s current challenges, we are implementing initiatives on multiple fronts to maximize value and provide the best path forward for Katerra and its many stakeholders.”

To fund its operations during the Chapter 11 process the company has secured US$35 million in Debtor-in-Possession financing from SB Investment Advisers (UK) Limited and is also selling off a number of its subsidiaries. These include its architecture business lines Lord Aeck Sargent and Renovations, which will be sold to private buyers.

According to Katerra, which was co-founded by former Flextronics CEO and former Tesla interim CEO Michael Marks, its international operations would not be affected by the Chapter 11 filing.

It added that it “intends to file customary motions with the Bankruptcy Court requesting authorization to continue paying remaining employees, vendors, and others in the ordinary course of business moving forward”.

Despite raising “several hundred million” in new financing from Japanese investor SoftBank Vision Fund in May of last year and recapitalising with a further $200 million, “principally from SoftBank Vision Fund 1” in December 2020, the company has not been able to stabilise its finances.

At the time the company’s CEO Paal Kibsgaard – appointed in July of 2020 – said, “The decision to recapitalize follows a thorough review of options available to us to enhance our financial strength and ensure Katerra’s ability to continue to pursue our goal of transforming the construction industry.”

While SoftBank is thought to have invested around US$2 billion in Katerra since its inception, it also shored up the balance sheet of financial services company Greensill Capital.

There is speculation that the now insolvent “former lender” of Katerra is Greensill Capital. A provider of supply-chain financing, Greensill Capital went into administration in March 2021 and is embroiled in an ongoing political scandal in the UK.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM