Match made in heaven? The Boels/Riwal deal

11 March 2024

Photo: Boels Rental

Photo: Boels Rental

Really significant acquisitions in the equipment rental sector don’t come around that often.

While a few deals spring to mind (United’s purchase of Ahern in 2022 and the more recent WillScot Mobile Mini deal for McGrath RentCorp for US$3.8 billion), they are few and far between.

The move by Boels Rental to acquire Netherlands-based aerial platform renter Riwal - the largest aerial platform renter in Europe - was not really on the horizon, mainly because there had been few signs that ProDelta, the investment business led by Doron Livnat, was interested in selling.

It brings some obvious benefits for Boels. It solidifies its position as Europe’s number two rental business, after Loxam, and signifies its growth ambitions, both in its core European market and wider afield.

The combined operations of Boels and Riwal would have generated $1.78 billion in revenues in 2023 (Boels at $1.47 billion and Riwal at $314 million), making it the eighth largest equipment rental provider in the world.

Geographical expansion

Even without Riwal. it was the fourth largest rental company in the region, behind only Modulaire, Aggreko and Loxam. The only fair comparison, though, is with fellow generalist Loxam.

This deal expands its footprint with Riwal’s 65 branches across 14 countries in Europe, the Middle East and South Asia, adding to Boels 750 locations.

Significantly, it gives Boels an entrance into Spain and France - two of the largest rental markets in Europe - as well as the United Arab Emirates (UAE), Kazakhstan and India. In the latter country, Riwal enjoys a 10% share of the country’s total access rental fleet.

Speaking to Access International’s Euan Youdale earlier this year, Munish Taneja, country manager for Riwal’s Manlift business (the brand used in India, UAE and Qatar), said the market in India offers the company huge potential.

Riwal’s business includes the Manlift-branded operations in India and the Middle East. Pictured are staff at Manlift India.

Riwal’s business includes the Manlift-branded operations in India and the Middle East. Pictured are staff at Manlift India.

“In the last two years we have done a lot of work in educating customers and the awareness is getting to an advanced level where customers understand the benefits, productivity, safety standards and efficiency at work sites”, said Taneja.

“But this awareness is not everywhere. When you look at India, which has 28 states, the major economic activity is in the west and south of India and that’s where we see higher penetration levels, compared to the east or some parts of the north.”

While no details have been revealed as to the plans for the Riwal brand, many will be monitoring how that market potential in India materialises for the company. Manlift already had plans to add two or three depots in India on top of the three existing depots in Greater Noida, Sanand and Penukonda.

Operational fleet

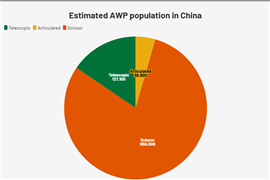

Prior to the acquisition of Riwal, Boels placed 9th on the access50 with 35,000 aerial platforms. With the addition of Riwal’s 20,000 unit fleet, the company now has 55,000 aerial platforms. That is second in Europe behind Loxam with 71,250 units. The total fleet value of the respective companies is in the region of €3.6 billion.

On the sustainability side, the deal furthers Boels’ strategy for zero-emission operations, with more than 60% of Riwal’s fleet electrified.

Boels described this as one of the biggest benefits of the purchase, having unveiled plans in 2021 to have the majority of its equipment fleet to be zero-emission.

It has since added a number of sustainable units to its fleet, including the addition of solar light towers, hybrid truck mounted platforms and electric telehandlers to its ECO label offering.

More recently, the company borrowed €100 million from the European Investment Bank (EIB) in January to support its decarbonisation strategy, with funds to be used to buy electric equipment.

In recent years Boels hasn’t been making really big acquisitions, preferring smaller-scale deals in markets including the Netherlands, UK, Sweden, Norway and Germany. What characterises several of these buys is that they were of specialist companies in power, site lighting and pumps.

The Riwal transaction can be seen in that context, of an extension of Boels’ specialist rental activities, albeit on a much bigger scale than normal.

Indeed, viewed alongside United Rentals’ recent acquisition of Yak Group - the portable roadway specialist in the US - it can be seen as part of a wider trend that sees specialist rental businesses bought by generalists. Only five of the world’s largest 20 rental businesses are now specialists (in power, portable accommodation and aerials).

It was already the case that there were relatively few, large specialist rental businesses to buy, which is in part what made Riwal so attractive. Apart from ‘giants’ like Aggreko and Modulaire and crane companies such as Sarens and Mammoet, there a small number of rental specialists of any significant size left in Europe.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM