Interview: mateco’s used equipment expansion

23 February 2021

mateco is expanding its global reach with a newly enhanced used equipment website, which also reflects a wider group strategy. Andries Schouten, mateco’s COO, explains.

Andries Schouten, COO, mateco

Andries Schouten, COO, mateco

As Europe’s second largest aerial platform rental company, mateco naturally has a significant fleet replacement programme and, therefore, a comparatively large number of used units that need to be moved out.

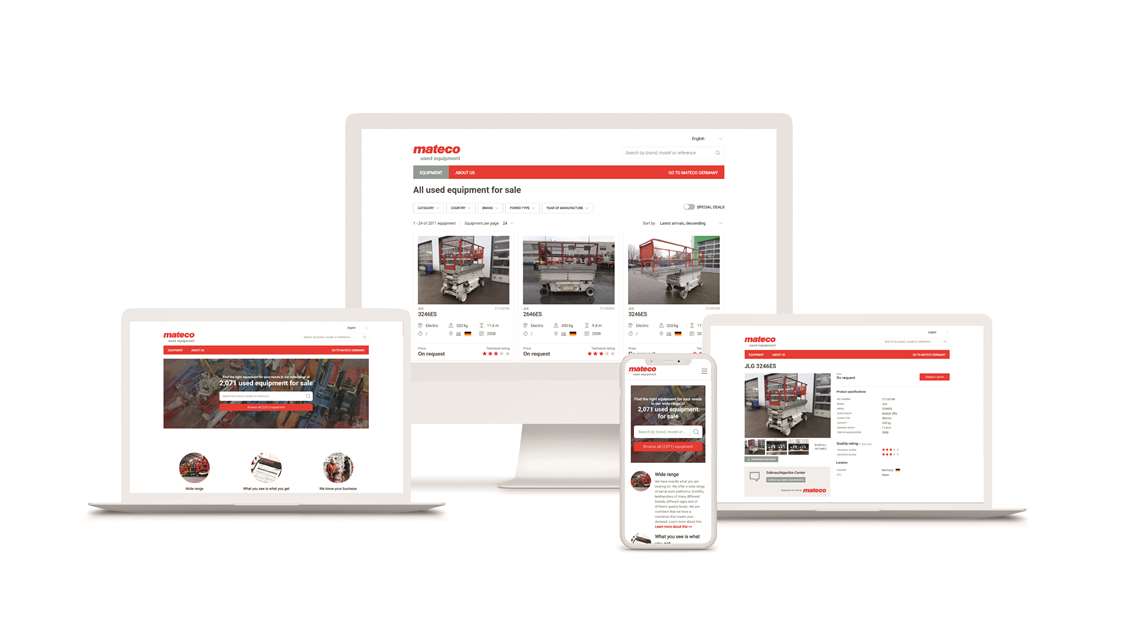

It now plans to harness that used fleet and grow its second-hand sales business, while seeking growth opportunities across the world. To achieve those goals, mateco has launched a new version of its website for used equipment, which now provides comprehensive and easily accessible data about the products that are available to buy.

Of the group’s 45,000-strong fleet, around 5,000 to 6,000 units will be replaced each year, most of which are sold on as used equipment. Given that more than 90% of mateco’s fleet comprises aerial platforms and to a lesser extent telehandlers and forklifts, the emphasis will be on those products. However, the group’s interest in generalist rental equipment is growing, with availability of used items for sale expanding at a comparative rate.

mateco used equipment website

mateco used equipment website

Since the onset of the Covid-19 pandemic, there has been a surge of used equipment as rental companies reduce their fleets in response to the weakening market and lowering utilisation levels. But, as Andries Schouten, COO of mateco, explains, the company’s vision for its used equipment online platform was envisaged before the pandemic emerged and reflects the group’s overall branding and growth strategy.

“Now is the right time to make ourselves more known to the MEWP market worldwide and that we have equipment available that is in good technical condition,” says Schouten. “It has nothing to do with the coronavirus situation; the plan was always to make us more known as a company that offers used equipment - not just older machines but younger too.”

The vast breadth and depth of the fleet is the result of the group’s major acquisition programme of the last eight years, which has seen it grow substantially across Europe and beyond, into one of the four largest access equipment rental companies in the world.

“That’s one of our strengths,” says Schouten, “We have been growing through acquisition, with each of those companies having their own equipment legacy, which means we can offer younger and older machines.”

It also means, Schouten adds, that the time has come to bring the group together, as a single, globally-recognised entity.

Acquisition history

The expansion by mateco’s former parent company TVH Group into equipment rental has been impressive. In 2011, the trading and parts specialist acquired Netherlands-based rental Gunco, swiftly followed by Germany-based rental giant mateco, in 2012. There have been a range of further acquisitions, with the notable example of Gardemann in 2018, which had been part of the Lavendon group until it was acquired by Loxam the year before.

Part of mateco’s MEWP fleet

Part of mateco’s MEWP fleet

It meant that the mateco holding had a large number of independent rental companies, all trading separately under their original names and the decision was made to streamline the group under the mateco banner.

As Schouten points out, “mateco has a good name in the industry and with our German activity being the largest we have, and the name being used in Poland and Luxembourg, a majority of our fleet was already mateco branded. So, we decided to use mateco in all countries and this created a situation where everything is aligned and we have a better view of the equipment available in each country. If we need a certain product it may be that colleagues in other countries have plenty available.”

This involved building a website for used equipment on which all the machines in the group are listed - approximately 2,000 at any given time, with the addition of a powerful new tool that provides buyers of used equipment outside the company an easy way of finding out exactly what is available.

Each unit on sale is labelled to show its age and is rated for aesthetics and working order, along with comments; while the pricing element of the site takes into account a range of factors, including market demand.

The website has taken shape over the last 1.5 years and has involved an in-depth analysis of the company’s existing pricing model, while benchmarking its offering against the wider used market.

The decision to put a machine up for sale is based on an intricate calculation, involving the current utilisation rate and number of new machines on order, among other geographical factors. Therefore, the back office tool, allowing the status of the machine to be switched between ‘for sale’ and ‘for sale but not published’ is a valuable option.

Mixed fleet

As Schouten says, the age of the mateco fleet varies from country-to-country, depending on the ethos of each company before it was acquired. On average, the mateco group has a relatively young fleet, reflected in an average age of around 4.5 years in Belgium and the Netherlands, for example. Whereas Gardemann, in Germany, had a relatively old fleet, which mateco has been in the process of replacing since the acquisition, bringing the fleet age back in line with mateco policy. Likewise, in Spain, mateco’s buyout of Afron and its aging 1,000-unit fleet, led to a gradual reduction in its age to around 4.5 years on average now.

However, Schouten says there are no plans to create a single average fleet age across the whole group. “It’s not really necessary to have the same average age in each country, since market situations and customer preferences differ. Between 2016 and 2019 we had some strong years with growth and new equipment investments. In Chile and Panama, we are looking to bring over machines from Europe that have been de-fleeted for utilisation reasons, so in the Latin American region we will have an older average age.

Between 2016 and 2019 the market had some strong years with growth and new equipment investments. Unfortunately, those strong years in Europe were replaced by the challenges of the pandemic early last year, which have continued this year. As a result, Schouten expects the first quarter of 2021 to

be as downbeat as 2020. “Once the vaccines have been introduced, hopefully we will have more freedoms. But the economy has been severely damaged, and 2021 will be a difficult year.”

Steady sales

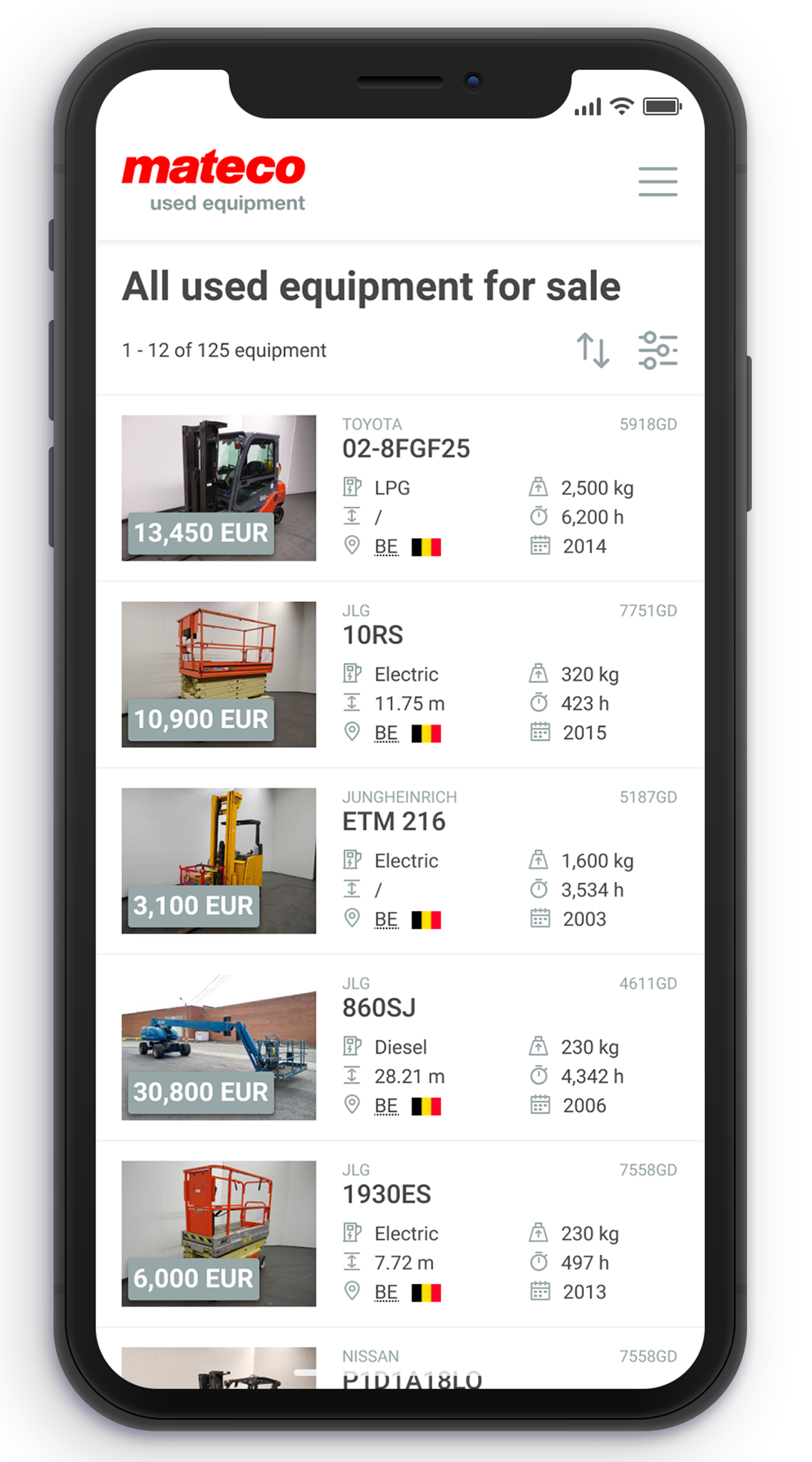

Mateco used equipment smart phone app

Mateco used equipment smart phone app

Used equipment sales during 2020 and 2021, on the other hand, have remained strong and in line with previous years. “We remain cautious, as there may be some pressure on pricing on used sales ahead, but in 2020 we were close to the year before. Some countries even saw a better year in 2020.”

Schouten continues, “I think 2021 will be quite a difficult year for manufacturers. The rental companies will be careful with their investments. The previous good years means a significant number of machines have been sold and most of the fleets are in decent shape, meaning most of them can wait one or two years to make investments again. When projects do arrive, then the lower investment and immediate availability of used equipment is a plus.”

The cautiousness of the rental companies is echoed by mateco’s own rental fleet capital expenditure. In 2020, the company invested 40% less in new equipment than in 2019, and Schouten forecasts the same level of investment for this year. Across the whole of the European rental industry, he believes the drop in capex spend will be closer to 65% in 2021, compared to 2019 levels.

Global interest

As Schouten explains, the used equipment website is designed to bring its saleable equipment to a worldwide audience, from which new business relationships can grow. “Today the majority of sales can be found in Europe, but our new website will help in growing sales outside of the old continent.”

The opportunities in South America are expected to contribute significantly to that, while Asia also offers vast potential in this area, despite its battles with Covid-19 and the varying levels of maturity in the access sector across the continent.

“More advanced access countries like Malaysia and Singapore are very slow at the moment due to the coronavirus. Other countries like Vietnam and India are just getting started and we can see coming up.”

Though mateco is planning to close Aerial Lift, its JLG distribution operation in Malaysia, partly due to the challenges of growing new equipment sales in the country and much of the region, the company will retain representation in the country and explore the whole continent from Europe, partly through used equipment.

“We have always been a company that offers a variety of products and services. In that sense used equipment sales can be a first step in a long-lasting partnership where we can offer

our entire scope of activities; used sales, new sales, re-rent, leasing,” says Schouten.

“We help in growing businesses by sharing our know-how and working out the appropriate growth trajectory. In the past this close collaboration was even further intensified via acquisitions as was the case with Statech in Czechia and Gépbér in Hungary. The original company owners are now country managers within our mateco group.”

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM