Forecast 2023: Hard or soft landing for construction equipment sales?

10 October 2022

Another good year for global construction equipment sales in 2021, but there will be a more pronounced downturn in 2023 and 2024

Although sales will be very strong this year, a slowing global economy and the higher cost of money will see a cooling in the construction markets which drive equipment sales. (Photo: KHL Staff)

Although sales will be very strong this year, a slowing global economy and the higher cost of money will see a cooling in the construction markets which drive equipment sales. (Photo: KHL Staff)

The following forecast was originally published in the September 2022 issue of Diesel Progress.

Last year saw an all-time record set in the global construction equipment market, with more than 1.28 million machines sold, according to Off-Highway Research. Those machines had a retail value of $127 billion – another record.

This year sees that buoyancy continue or even improve in most parts of the world. An ongoing lack of inventory, longstanding component shortages and transportation bottlenecks have meant that lead times have stretched out to the extent that many OEMs were sold out for 2022 before the year had even started.

Indeed, as high as sales were in 2021, they might have been even greater had manufacturers been able to meet demand, which was driven by the extraordinary – and perhaps excessive – stimulus programs seen around the world.

Although sales will be very strong this year (although not another global record – more on that later), in some respects, 2022 was the start of the hangover from the stimulus party. Interest rates were kept too low for too long around the world and will now have to go up sharply to combat levels of inflation which haven’t been seen since the early 1980s. This will almost certainly lead to a recession, which will push down construction equipment sales.

Sales take a hit

In direct terms, inflation and high interest rates will hit sales as machines become more expensive and the cost of financing purchases rises. More fundamentally on the demand side, a slowing economy and the higher cost of money will see a cooling in the construction markets which drive equipment sales. The impact of rising interest rates is already being seen in the number of completions and permits granted for residential construction in the U.S., for example.

Add to that the fact that sales of equipment have been at historically high levels for an unusually long time. A peak in the industry usually lasts for one or two years, but the global market has set all-time sales records for the last four years in a row. That means there are a lot of young machines out in the population. If and when construction activity falls away, the presence of all those young and suddenly under-utilized machines will likely be a barrier to new equipment sales.

2022 not a record

Although most manufacturers and distributors will tell you they are sold out for 2022, this year is unlikely to see a fifth straight record for worldwide construction equipment sales. The one market which is out of phase, and which has been since the pandemic started, is China.

First, the Chinese market soared to levels not seen for a decade in 2020, as stimulus was quickly put in place in the spring as the country came out of its first COVID-inspired lockdown. Construction equipment sales in China grew 30% in 2020 from already high levels the previous year.

But for other countries of the world, 2020 was generally painful. The best performers saw sales stay flat with 2019 levels, but most saw falls of the order of 5% to 25%.

Fall in China

Stellar sales in China continued for a year, culminating in a sensational first quarter in 2021. Although the market then fell for most of the rest of the year, 2021 as a whole was still very good, with the fourth highest unit sales ever seen in China.

However, 2022 has seen the fall not only continue but steepen. China’s combination of a zero-COVID policy and its own not particularly effective vaccine saw long and strict lockdowns reintroduced in many major cities in the first half of the year. This enforced inactivity has translated to a painful slowdown for the Chinese economy.

More stimulus has been announced, which will help in the second half of 2022, but the Chinese equipment market is still expected to fall 47% this year, wiping more than 145000 machine unit sales off the global total compared to last year. Even though the whole of the rest of the world is seeing growth, it won’t be enough to offset this fall.

While most markets will rise this year, global equipment sales will fall around 10% in 2022 because of the downturn in China. Bear in mind that is coming from an all-time high in 2021, so this year will still be the third or fourth best ever seen. And also bear in mind that it is only really China which is falling. Many other countries will see very strong, if not record sales in 2022.

Distributors in those countries might well tell you that for the second year running, sales in 2022 could have been much higher if only they had the machines to sell.

There is concern that inflation, rising interest rates and the presence of lots of young machines will hit the industry hard at some point next year once the backlog is worked out. (Photo: KHL Staff)

There is concern that inflation, rising interest rates and the presence of lots of young machines will hit the industry hard at some point next year once the backlog is worked out. (Photo: KHL Staff)

Prices rise

That problem of big backlogs, transportation logjams and long lead times will mean the current buoyancy will carry over into the start of 2023. However, the concern is that inflation, rising interest rates and the presence of lots of young machines will hit the industry hard at some point next year once the backlog is worked out.

Just considering affordability of machines is striking. Most manufacturers are trying to implement price increases on the order of 10% this year to pass on the increases they are seeing in labor, materials, energy and shipping costs.

As big as a 10% annual rise is, this does not fully pass on the input cost increases to date and those which are on the horizon, so many OEMs are talking about another 10% price rise next year. Add to that increased finance costs because of higher interest rates, and a customer could potentially be looking at paying 25% more for a machine in 2023 compared to late 2020/early 2021.

Positive drivers

Still, things are not all doom and gloom. Global infrastructure markets were good going into the pandemic and they have been strengthened through stimulus spending commitments around the world. The $1 trillion U.S. infrastructure bill of 2021 – officially the Infrastructure Investment and Jobs Act (IIJA) – is the most widely talked about, but there are many other countries which are looking to infrastructure investment as a way of buying their economies back to health.

Such schemes are of course good news for the construction equipment segment, as they require machines to build them. Big infrastructure projects also tend to take many years to complete, so they provide a degree of medium-term stability and certainty.

Looking ahead

As a result of these conflicting pushes and pulls in the global market, this year’s 10% decline in sales is expected to be followed by a similar drop next year. That would still keep the market above 1 million machines sold worldwide, so it would still be regarded as a healthy market.

About the author: Chris Sleight is managing director of Off-Highway Research, a management consultancy specializing in the research and analysis of international construction and agricultural equipment markets. A KHL Group company, Off-Highway Research is based in Wadhurst, East Sussex, U.K.

About the author: Chris Sleight is managing director of Off-Highway Research, a management consultancy specializing in the research and analysis of international construction and agricultural equipment markets. A KHL Group company, Off-Highway Research is based in Wadhurst, East Sussex, U.K.

But there is a difference between good volumes and demand trending upwards, and good volumes with a downward trajectory.

That slowdown is expected to continue into 2024. At present, Off-Highway Research’s forecast is for a soft landing in 2024, before the market gently picks up again in 2025.

But forecasting even two to three years ahead in the uncertain and unpredictable times we live in is a challenge. So many diverse and unknowable factors play into the economic landscape – from China’s ongoing battle with COVID, to the ups and downs of global commodity prices (and the influence of Russia’s war on Ukraine in this), to the actions of hundreds of central banks and the policy responses from thousands of politicians.

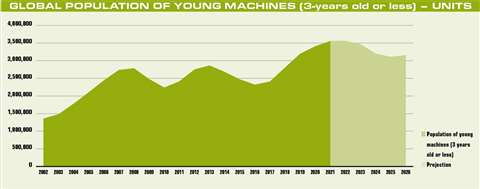

Year-to-year sales of construction equipment can swing quite violently but looking at the population of equipment active in the world gives a different picture. Construction machines can be long lived, particularly some of the heavier types such as graders and dump trucks. This means that changes in machine population tend to be smoother and they can also be counter-cyclical.

Getting a true picture of total machine population across all types, with their different utilization rates and applications, is complicated. A quick and useful proxy is to simply look at the population of young machines – say those which are three years old or less.

This is illustrated in the chart, and it shows just how much the machine population has built up since the late 2020s. Even with a downturn coming, there will be more than 3 million young machines in the global fleet for the foreseeable future – more than at any previous point in history.

This matters because it doesn’t take much of a dip in construction activity to leave so many machines under-utilized and therefore a barrier to new equipment sales.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM