Read this article in French German Italian Portuguese Spanish

Debating rates: EU revises tariffs for Chinese-made MEWPs following anti-subsidy investigation

02 May 2025

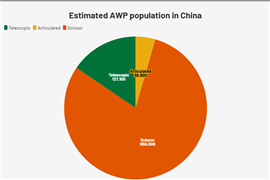

The European Union has announced it is imposing new tariffs on mobile elevating work platforms (MEWPs) imported from China, designed to make up for Chinese state subsidies. Euan Youdale asks manufacturers how the new charges are set to affect sales and production.

Photo: Adobe Stock

Photo: Adobe Stock

Chinese manufacturers of mobile elevating work platforms (MEWPs) importing machines into Europe are to remain under significant tariff pressure after the EU said it would introduced new charges levied on companies benefitting from indirect state subsidies.

After launching a probe into the sort of subsidies being received by Chinese MEWP manufacturers, the EU said it had introduced new anti-subsidy tariffs ranging from 0% to 14%.

The tariffs come on top of a series of anti-dumping duties which the EU imposed last year, ranging from 22% to 49% on MEWPs originating from China following an investigation into allegations of Chinese OEMs ‘dumping’ stock into the market at unsustainably low prices.

Revising original tariff levels

However, the EU said that the two duties would not be imposed on top of each other but instead it was revising the original tariff levels to take into account the latest findings (see table) so that it would avoid ‘double counting’ or doubling up on the rates being charged.

In many instances the new measures have resulted in slightly lower total tariffs for individual OEMs.

The tariffs apply to self-propelled aerial platforms—including articulated and telescopic booms, scissor lifts, and vertical masts with working heights above six meters. They also cover pre-assembled or ready-to-assemble structural elements like chassis, turrets, and lift mechanisms, but exclude standalone components and vehicle-mounted aerial devices.

The anti-subsidy enquiry specifically examined how Chinese government policies might give manufacturers an unfair advantage in the EU market. The European Commission stated that “businesses in China operate in a specific environment which… features numerous mechanisms that provide the Government of China (GOC) with substantial degree of control over any aspect of the economic activity in the country.”

Photo: Adobe Stock

Photo: Adobe Stock

According to the Commission, this influence distorts market behaviour: “This tight control prevents economic operators from acting as rational market operators seeking to maximise profits, and in fact forces them to act as an arm of the government in implementing its policies and plans.”

Furthermore, the Commission highlighted the state’s role in China’s banking sector: “China’s financial system remains dominated by the banking sector and the state controls the banking sector through ownership, as well as through personal ties.”

The conclusion? Chinese manufacturers benefit from preferential financial conditions such as low-interest loans and subsidised bonds—benefits that the EU deemed countervailable subsidies.

The investigation also scrutinised the financial state of selected OEMs, comparing their solvency and liquidity risks with the financial assistance they received. In some cases, they found investments that could only be explained by non-commercial motives, like compliance with state policy.

“Only investors having motivations other than a financial return on their investment, such as compliance with the legal obligation to provide financing to companies in encouraged industries, would make such an investment,” the Commission noted.

As a result, the EU confirmed that exporters were receiving unfair financial advantages in the form of credit lines, bank drafts, and preferential bonds, which led to the imposition of the anti-subsidy duties. To avoid ‘double counting’ penalties, the EU revised the earlier anti-dumping tariffs, leading in some cases to lower overall duties.

Both investigations stemmed from a formal complaint by the Coalition to Restore a Level Playing Field, a European industry group which includes French MEWP manufacturers Haulotte and Manitou which worries that an influx of competitively priced Chinese-built MEWPs—many of which feature cutting-edge software— is distorting the European market.

Protectionist responses

Already similar claims by manufacturers across a range of industries has led to a wave of protectionist responses across major markets. In 2021 the US International Trade Commission announced countervailing tariffs ranging from 11.95% to 448.70% on Chinese MEWP imports.

“[What happens next] depends on the behaviour of the competition,” said Haulotte CEO Alexandre Saubot, speaking to Rental Briefing. “I never bet on the behaviour of the competition. I try to envisage all of the options and be ready for all of them. They will have to decide if they increase their selling price or if they squeeze their margin to keep where they are. That’s not my call. The worst thing for us is if they squeeze their margins and the tariffs have no effect but they also need to make money one day.”

Saubot noted that Haulotte’s own China-based factory does not export to the EU, so it is not affected by the duties. He also cautioned that the current wave of imports cleared before the duties came into force means that the real market impact won’t be visible until 2026.

Meanwhile, Chinese firms have rejected the EU’s findings. The China Chamber of Commerce for Import and Export of Machinery and Electronic Products (CCCME) claims the sampling process used was flawed, and argues that more affordable aerial platforms contribute to improved safety for European workers.

The new tariffs are also prompting some Chinese OEMs to relocate manufacturing to Western markets to avoid tariffs. Names like JLG, Sinoboom, LGMG and Zoomlion—all of which exported MEWPs from Chinese plants—are among those rethinking their production strategies.

A digital render of Zoomlion’s new factory in Hungary, which will produce MEWPs for the European market (Image courtesy of Zoomlion)

A digital render of Zoomlion’s new factory in Hungary, which will produce MEWPs for the European market (Image courtesy of Zoomlion)

Zoomlion, for instance, recently announced a €100 million investment in a new Hungarian facility focused on MEWP production.

The Hungarian site will be developed by European listed developer CTP, adapting a 35,000 square metre logistics facility and adding a 20,000 square metre testing area for scissor and boom lifts.

At Bauma, Zoomlion Access General Manager Ren Huili told Rental Briefing the duties had forced the company to speed up plans for localised production: “The tariffs are there and cannot do anything about that. We will just stick to our plan to manufacture locally – as a global local company, not just a trading company.

“In Europe, we will have R&D, manufacturing, services and a sales pool and we will put Hungary at the centre of our European operations.”

JLG Industries has also started shifting production to Europe. The US-headquartered firm, which previously produced in Tianjin, has ramped up European operations through facilities such as the recently acquired Hinowa plant in Italy, its Power Towers site in the UK, and Spanish material handling firm Ausa.

Localised production

Although JLG avoided anti-subsidy penalties, the company remains subject to anti-dumping tariffs. Speaking about the case, Narang said, “We didn’t agree with the approach taken by the European Commission, and we will of course work with them to appeal it. It didn’t change our decision [for local manufacturing], I think it just accelerated the process.”

“Our pricing is one of the highest in the industry and we were fined because we did not have a single economic entity, they looked at us [the factory in China] as separate entities and said ‘you are dumping’. But if you look at us as one entity and look at our price we don’t think we were dumping,” he added. “That said we respect what they do and in the end they accelerated our journey to localisation. It doesn’t matter what the level of tariffs are if we produce in Europe.”

| Company | Anti-subsidy

‘Countervailing’ duty |

Anti-dumping duty |

| Hunan Sinoboom Intelligent Equipment |

7.3% |

42% |

| Zoomlion Intelligent Access Machinery | 11.6% | 30.1% |

| Zhejiang Dingli Machinery |

14.2% |

6.4% |

| Oshkosh JLG (Tianjin) Equipment Technology |

0% |

22.5% |

|

12.1% |

22.9% | |

| Other cooperating companies (Annex I) | 12.1% | 30.1% |

| Other companies cooperating in the anti-dumping investigation but not in the anti-subsidy investigation (Annex II) | 14.2% | 30.1% |

| Other companies non cooperating in anti-dumping investigation but cooperating in the anti-subsidy investigation (Annex III) | 12.1% |

54.6% |

| All other companies |

14.2% |

52.5% |

1. For non-cooperating companies, the Commission applied the highest duty rate from cooperating sampled firms.

2. For cooperating non-sampled companies, average rates from the sample were used.

Annex I

- Lingong Heavy Machinery Co

- Terex (Changzhou) Machinery

- XCMG Fire Fighting Safety Equipment

- Haulotte Access Equipment Manufacturing

- Fronteq (Changzhou) Machinery

- Jiangsu Liugong Machinery

- Hangcha Group

- Shandong Chufeng Heavy Industry Machinery

- Mantall Heavy Industry

- Jinan Juxin Machinery

- Shandong Yuntian Intelligent Machinery Equipment

Annex II

- Reeslift

- Shandong Qiyun Group

- Sunward Intelligent Equipment

Annex III

Zhejiang Noblelift Equipment Joint Stock

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM