China rental shift

08 August 2019

The shift to equipment rental in China is happening at a frightening speed in the aerial platform sector, but is proving a harder task with earthmoving equipment. That’s partly because the ownership model is so entrenched – in some cases a contractor’s ‘stature’ is measured by the size of its machinery fleet – and in part because there is a massive ’informal’ rental market for earthmoving equipment, with countless thousands of excavator and wheeled loader owner-operators available on ‘rental streets’ throughout China.

Now, however, there are signs that a shift is coming, and it’s no surprise that it is in heavy equipment that this is happening, with separate rental projects underway by Japanese-based rental company Kanamoto and manufacturer Hitachi.

Kanamoto had been operating in China since 2009 through a rental joint venture, Shanghai Jinheyuan Engineering Construction, but Tao (Tom) Lu, the Director and General Manager of Shanghai-based Kanamoto (China) Investment Co, tells IRN that Kanamoto’s share in the JV is now a minority one, with its focus shifting to a new ‘project-based’ rental model operated by the new Kanamoto subsidiary.

“The JV was losing money, that was a key reason for the shift in focus”, says Lu, “Second, I’m not sure that a JV is the best way to do business in China. I think we can do better by ourselves.”

Lu, who has spent long periods working for Komatsu as well as Chinese construction equipment OEMs, came to Shanghai with the subsidiary in September 2017, and quickly opted for a new strategy; “We had to do something different from traditional rental companies. We didn’t have a service team or a sales team, so we had to think differently. The project-oriented model is now our focus. We supply machines and rely on the manufacturers to provide after sales service and maintenance.”

The first contract, signed in April last year, was for a four-year rental agreement with mining equipment specialist Xinjiang Junrui Zhongyan Mining Equipment Co., Ltd (Junrui Zhongyan). The deal includes six new Caterpillar 390 excavators and 70 new 60 tonne SDLG mining trucks, with the equipment having a total value of RMB100 million (€13 million).

Junrui Zhongyan is in China’s northwestern Xinjiang Uygur Autonomous Region and was established in 2015. It began offering excavation services on an open-pit coal mine south of the Tianchi (or Heavenly Lake) region and has a fleet of more than 30 large excavators, 100 units of supporting equipment, and 150 dump trucks. The company has won contracts for seven of the nine open-pit coal mines in the coal field south of Tianchi and is set to excavate more than 60 million tonnes of material annually.

“We are perhaps the first company to do this kind of rental business in China”, says Lu, “I think currently, sub-contractors purchase equipment from OEMs and put them to work in mines. But in the future they will rent. Not all of them, but some.”

He differentiates the Kanamoto model from dealers who lease equipment to customers, with customers buying the machine at the end of the lease. “With Kanamoto, we will take back the equipment. We only rent the machine”, says Lu. He also highlights a very lean operation, with only 10 Kanamoto employees involved so far.

He says this first contract will soon be followed by two further projects, one for a mine linked to a cement works and another with a coal mine. The cement plant will involve the rental of 30 large Hitachi machines, while the coal mine will involve a mix of 44 large machines from Caterpillar and SDLG.

He says the benefit for the contractor is the absence of a 30-40% down-payment on buying a new machine, and it removes the problem of getting finance; “Also, the contractor doesn’t know how long the project will take, so we are giving them flexibility.”

Lu says they will also offer the option of Kanamoto acquiring machines that a contractor has recently bought and supplying them back on a rental basis, or replacing old machines with new rental units.

In addition to these project-based deals, Kanamoto will also start building a more traditional rental business, with 50 to 60 excavators in the 30 to 40 tonne range, and probably in Guangdong Province in the South. “The economy there is growing very quickly, there is lots of infrastructure work”, he says.

There is no plan to rent smaller units, not yet at least; “I think in several years China will move the same way as foreign countries and rent smaller machines.” He thinks these smaller units will become more popular as China starts to maintain and repair the massive infrastructure networks it has put in place over the past 15 to 20 years.

Another approach is being taken by Hitachi, which, alongside Caterpillar, has been one of the OEMs most involved in rental activities. Hitachi has operated a rental concern in Japan for many years; has launched a rental wholesale and dealer rental initiative in Europe over the past 18 months; and is now embarking on a similar initiative in China.

Since last October, Hitachi Construction Machinery (Shanghai) Co Ltd, has embarked on a ‘multi-channel’ rental programme that includes holding its own wholesale rental fleet to support dealer rental operations; directly supplying machines to independent rental companies; and selling machines with service back-up to ‘rental sales partners’.

Leading the strategy is Tei Gyomei, Managing Director of Hitachi CM (Shanghai), who is a former Caterpillar executive in Japan who is known also under his Chinese name, Xiaming Cheng. Speaking to IRN in Shanghai, Tei says Hitachi had invested in 100 Hitachi excavators – all 20 tonne or above – for its wholesale rental fleet, with an additional 500 units to be added this year. These will be rented to its dealers, who will be responsible for finding rental customers.

In addition, Hitachi aims to forge rental alliances with independent rental companies and will sell or rent machines to businesses that satisfy defined quality and financial criteria.

The final part of the strategy is to sell machines to rental partners, with the provision of full product support and servicing. In fact, it is Kanamoto who is the first of these partners, acquiring very large machines for mining applications (see above). Horizon Equipment is another partner, having bought as many as 20 Hitachi drilling rigs last year.

Tei, who will discuss the Chinese earthmoving rental market in a presentation at the International Rental Conference (IRC) in Shanghai on 22 October, says it is his view that rental of machines smaller than 20 tonnes will not be profitable.

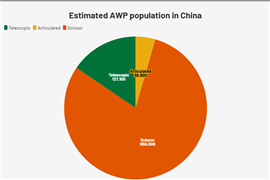

He thinks the Chinese rental market for earthmoving equipment will grow, and he points to the dramatic expansion of the aerial platform rental market, with China “achieving in 10 years what in Japan had taken 30 or 40 years.”

“China’s earthmoving market will start from the state-owned enterprises”, says Tei, “They are trying to reduce their balance sheets.” He adds that state-owned contractors are also looking to take risk out of their asset disposal activities, in the wider context of China’s anti-corruption drive.

What is more, an increased focus on jobsite safety is pushing contractors to use fewer sub-contractors, instead choosing to work with a smaller number of larger contractors. “So we are moving towards larger sub-contractors”, says Tei, “Right now they buy machines, but I can see that they will move to rental.” Pushed along, no doubt, by Hitachi, Kanamoto and others.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM