Aerials grounded: Murray Pollok reports on the aerial platform rental sector.

16 October 2009

For many of the bigger rental companies in the world the focus just now is de-fleeting - selling off excess machines as demand falters. Nowhere is this more evident than in the aerial platform rental market, with access equipment being a big component of many general rental fleets and highly dependent on the non-residential construction work that has been so badly affected by recession.

It is no surprise to see rental companies advertising used lifts on their website - in the US, for example, H&E Equipment Services is offering a "used AWP liquidation sale" at "deeply discounted" pieces (take a look at www.he-equipment.com). Just in case anybody needs extra encouragement, H&E advises that "no reasonable offer will be refused".

In Europe, Spanish renters have been shedding aerial platforms in their thousands, while Hewden in the UK - to name just one - held an auction in mid-September at which at least 80 of its booms and scissors were up for sale.

This, of course, is deeply troubling for the manufacturers - few customers willing to invest in new equipment, and anyone who is in the market has a vast choice of used machines to look at first. Both JLG and Terex AWP's results for the second quarter of the year tell the story, over 70% down on the same period in 2008 (Haulotte reports at the end of August.)

"We estimate that the market is down approximately 80 percent for aerials and telehandlers", says Linda Mayer, vice president global marketing and product management, Terex AWP, "The overall market is facing tough challenges in both the residential construction market as well as the commercial construction markets.

Ms Mayer says there are signs that residential construction may have bottomed out, but there hasn't been any significant increase in activity; "The commercial construction market continues to indicate decline."

"No one knows for sure when we will see the economy turn around", she says, "We do believe though that we have already seen the bottom. The real question is whether the re-bound will be ‘u' shaped or ‘v' shaped. Currently, we expect the rebound to be more of a ‘u' shape, which means that it will be some time before we see demand levels like we saw in 2006 - 2007."

Terex is responding by reducing its manufacturing footprint, taking production costs out of its most important products, negotiating with its suppliers, and keeping a tight reign on expenses. "All of these efforts are helping to create a strong position for when the market does return", she tells IRN.

Back at the rental companies, the story of de-fleeting is well illustrated by the recent Access-50 survey of the largest access rental fleets carried out by our sister magazine, Access International. The top five companies having reduced their aerial fleets by an estimated 8% over the past 12 months, and the top 10 by 6%. Overall, surprisingly, the top 50 fleet - around 450000 units - is steady compared to last year, although this reflects the investment and acquisition activity that was still going on before the crash in late 2008.

United Rentals is estimated to have cut its aerial fleet by 10% - that's equivalent to around 7000 machines. The de-fleeting continues in North America because demand continues to be weak and because utilization rates are still considerably lower than this time 12 months ago - between 8% and 10% in the case of Hertz Equipment Rental Co (HERC), another big access owner in the US.

Gerry Plescia, HERC president, speaking recently during the company's investors' conference call, estimated that de-fleeting would continue for several quarters, with the likelihood of some kind of stabilisation of the fleet and utilisation by next Spring or Summer. Like other big US renters, HERC's revenues have fallen steeply compared to last year - 34.6% for the three months to 30 June - and the company said the business was "hovering near the bottom" of the recession.

Meanwhile in Europe, uncertainty continues to surround the access rental business. Alan Merrell, the long-time financial director of Lavendon Group, gives IRN a fairly downbeat assessment of how its various European markets are performing.

In the case of the UK, its largest single area, Mr Merrell says Lavendon anticipates another difficult 12 months; "It's fair to say it's not deteriorating at the same extent as the 4th quarter last year and the 1st quarter this year, but I still don't think it's on an improving trend."

Spain continues to be "very, very difficult" with little prospect of any improvement over the next 12 months, while France and Belgium (where it has a boosted presence thanks to its acquisition of DK Rentals) are down, but "reasonable" in comparison to the UK and Spain.

More worrying, however, is Mr Merrell's view of the Germany market, where the access sector has so far seemed to be less impacted by recession. He says there has been some decline, although not to the extent of the UK, but that Lavendon fears that Germany might be on a time lag; "if GDP falls by 6-7% [as widely predicted] then it would have an impact."

Concerning also for manufacturers is Mr Merrell's view on fleet investment. Europe's access fleet has an average age of around five years; "As an industry", he tells IRN, "we could take an [investment] holiday next year. Absolutely. It could even go on for the following year. If necessary, people will not buy equipment, because they will look to generate cash. People will spend some money, but major replenishing of the fleet - why do it?"

Another big European player, Height for Hire in Ireland, has a foot in several camps, with access rental operations in Ireland, the UK and Slovakia. Its managing director John Ball tells IRN that Ireland remains a very very difficult market, but it has leveled out. We hope it has bottomed."

Height for Hire has moved as much as 20% of its Irish fleet into Slovakia and the UK. In these markets it operates as Easi Uplifts, and it has recently opened a fifth location in the UK, in east London. The company has double to 300 the number of machines in Slovakia. "Some large projects there have been put on ice - some have started and stopped, and some not started. We're now looking at alternative users. We've built the fleet to a certain level and are holding it at that."

Mr Ball says the company is still spending money - recent acquisitions include four new large Bronto Skylift truck mounted platforms and some large booms from Genie. "We will be more selective in investment going forward", he says, "We are still spending, but our focus is on larger equipment. Capital expenditure will be well down on previous years."

It is good to hear that another of Europe's largest access renters, Netherlands-based Riwal, has a generally optimistic view, as Dick Schalekamp, the company's managing director, explained to IRN; "We are definitely less negative than most others regarding the last 12 months and therefore probably more positive about the next 12."

He says group revenues in the first six months of the year are even or "just slightly less", with most of its countries either level of still increasing; "Spain has been hit very hard: both volume and prices are down", he says, "but also over there we are outperforming the competition. Riwal Croatia is doing exceptionally well and we are pleased with our first results in the UK. But also in other countries we believe our people are making the most of the situation."

It also seems to be a strange time to entering the UK market - Riwal established an operation there over the summer - because it is one of the more difficult in Europe at the moment; "We truly believe that in the UK market there is a niche for a quality supplier", says Mr Schalekamp, "Even in this economy there are people willing to pay for quality, reliability and especially for equipment that is hard to get in the UK. Especially for scissors over 20 m; booms over 25 m, but also for narrow width platforms, spiders and truck mounts from 30 to 103 m, customers are calling us on a daily basis."

Mr Schalekamp thinks the rental industry in Europe will face another few bad months and then pick up slowly; "However, in sales of new machines we think that it will take at least another 15 to 18 months from now [late August] before it will improve significantly." Riwal will itself reduce spending this year by 65% and - look away - a further halving of that is anticipated next year.

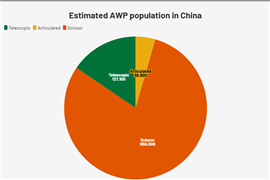

The problem for the access suppliers is that developing markets remain just that - developing. China remains a market for the future; Latin America has promise but has still to deliver consistent, high volumes of sales; and the demand for rental services in eastern Europe has fallen just as quickly (or more so) than in the west - just look at the financial results of Cramo and Ramirent.

Wayne Lawson, vice president of JLG and head of customer support for EAME (Europe Africa and the Middle East) says the Eastern European market falls into two broad markets. "There are the countries which more closely follow the trends in Western Europe," he says, "such as Poland, Romania, the Czech Republic and so on. And there is Russia and the former soviet states where the market is based on energy and infrastructure." Unfortunately, he says, "Russia has been impacted by a downturn in its traditional export markets and a lack of liquidity and commodity prices."

Meanwhile, the Middle East, even if it is off the pace of a few years ago, still represents a good area, with the growth focus shifting from Dubai towards places like Saudi Arabia and Abu Dhabi.

So the message is that renters still face some challenging times, and even more so for the dealers and manufacturers. Still, anyone in the market for decent quality used aerial platforms will find themselves spoiled for choice. Try making H&E Equipment an offer they can't refuse.

ACCESS SHORTCUTS

• A 19 m working height, battery powered scissor lift is soon to be launched by Italian manufacturer Iteco. With 4x4 traction, automatic levelling outriggers and a 5.8 m extended deck, Iteco's Corrado Conti says the lift is "a healthy alternative to diesel machines for construction, especially during the finishing phase of industrial buildings." The machine can travel up to a maximum platform height of 14 m, and the stabilisers don't need to be lowered when the lift is working on a level surface. Cage capacity is 580 kg and the 630Ah traction batteries will take the lift through a 12 hour shift.

• Leopold Mayrhofer, chairman of System Lift, the access rental franchise that has 70 members in Germany, Austria and Switzerland, believes its locally-based members have a chance to outperform their bigger, national rivals during the recession. "This is a bad market for the big rental companies with lots of staff to support," he says. "Each of the System Lift members has lots of customers and long, often personal, relationships with them, so these market conditions are less damaging. Our utilisation rates are down, but only by 20 to 30% which isn't too bad, and that is down to individual sales strength."

• UK airline easyJet has bought seven Genie aerial platforms mainly for aircraft maintenance work at Luton Airport. The machines - four electric GS-2032 scissor lifts, a diesel GS-2668 RT scissor and two Z-45/25 J Bi-Energy booms - were supplied by Platform Sales and Hire Ltd

• The Power Tower Nano platform is just one of the new fleet of low-level access platforms ordered by the UK's Speedy Hire. The £0.6 million investment also includes the Nano's bigger brother, the Power Tower; the Italian-made Leonardo lifts from Braviisol (sold by Bravi UK); and the low-weight Hy-Brid electric scissors from Custom Equipment in the US. Speedy has produced a low level access guide to help customers select the most appropriate lift.

• Isoli is offering a 14.2 m working height, 6.7 m outreach lift on a Land Rover Defender carrier. The manufacturer says the Isoli MPT 140 is perfect for working in confined spaces. The company has also completed testing on its new 28 m PNT280J truck mounted lift and has begun series production. The unit, which has a Sigma-style dual riser and telescoping upper boom, is pitched at the highly competitive 7.5 t/28 m truck mounted sector.

• German manufacturer Ruthmann says its new 47 m working height T 470 truck mounted platform has been winning favour with several European rental companies. The first buyer was French rental company Joly-Location, and orders have subsequently been received from companies including Borhite, based near Bruges in Belgium, and German renter Starlift. A key feature of the T 470 is its ‘Orbital-Boom' technology that makes the book rigid but light.

• Palfinger Platform, the aerial platform division of the crane manufacturer that includes the Wumag business acquired in 2008, has added a 22 m working height, aluminium boom truck mounted model to the 26 m unit launched at Intermat. The 3.5 t GVW class P220 B offers maximum outreach of 14.5 m and Palfinger says the hydraulic system and multi-step automatic speed increases "make it one of the fastest and most effective platforms in its class."

• This 18 m E180PX platform from GSR can be driven on a Euro B driving licence for vehicles up to 3.5 t GVW. With a basket capacity of 250 kg, the unit has the option of narrow jacking with four vertical outriggers. The unit can be mounted on most common commercial vehicle chassis, such as Nissan Cabstar, Iveco EcoDaily, Mercedes Sprinter EU5, Renault Maxity, Volkswagen Crafter and Ford Transit.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM