Access Confidence Survey - how will the sector perform in 2022?

05 January 2022

The Access Confidence Survey of equipment rental companies, manufacturers and end users shows a positive outlook for 2022, considering the ongoing challenges across the access sector.

Looking at the results of the survey’s Confidence Index, which asks respondents to forecast the opportunities for their business over the next five years, out of a maximum 100 score, the average response this year is 66.8.

This represents a slight drop from the 68% index score in last year’s edition of this survey. This could be due to confidence rising at the end of last year, thanks to much of the industry bouncing back from the pandemic in the second half of 2020.

It is possible that today’s continuing pressures, including lockdowns across many parts of Asia throughout this year and the more recent new restrictions introduced to European countries, along with ongoing concerns in North America, has taught industry professionals to be a little more cautious.

On the other side of the coin, the five-year Index forecast, contradicts the forecasts across rental companies, manufacturers and end users for the coming year alone. Expectations for the industry, particularly in Europe and North America, are high, with manufacturers and rental companies reporting strong financial results.

Positive trends

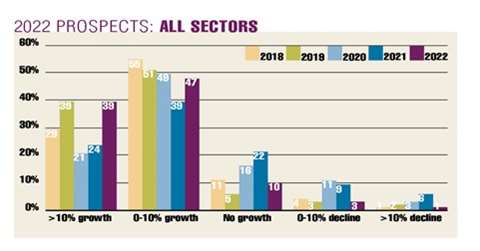

2022 Prospects - All Sectors, (rental companies, manufacturers and end users).

2022 Prospects - All Sectors, (rental companies, manufacturers and end users).

This is reflected in the Prospects for All Sectors table, which shows nearly 40% of respondents believe there will be more than 10% growth in 2022, compared to 24% last year. That trend continues through this graph, with significantly fewer forecasting downturns next year than was the case last year.

Splitting out the rental companies, it is apparent there is a similarly high level of confidence among them. Of course, one experience does not fit all internationally, and in areas such as Southeast Asia, which has suffered lockdowns throughout this year, there is bound to be a lower level of confidence.

There are also fewer rental companies in this region, which means they are crowded out somewhat by the greater number of companies that are based in the mature markets.

Similarly, looking at the data from manufacturers specifically, the expectations of a continued market rise is obvious, with a greater percentage of them forecasting growth in 2022, than this time last year for 2021. Sales expectations are up considerably too, compared to last year’s confidence level.

Again, this is in line with the recovery in North American and European markets, along with continued exceptional growth in China.

There is no real evidence of the supply chain issues, which are extending lead times and increasing costs, until we look at the expectations of investment in used equipment by rental companies and the price levels from the manufacturers. Both these relevant tables show an increase on last year, with more rental companies looking to increase their spend on used equipment, than they were expecting to this time last year.

In response to the increasing costs of materials, manufacturers say that overall their prices for MEWPs will rise next year, in comparison to the view in 2020.

Rate rises

How does this correlate with the forecast for rental rates next year? Well, from this survey, it does seem that rental rates are going up considerably in 2022. Equipment price increases are often not passed on through rental companies to their companies for an array of reasons, however, it seems the overall view is that the time has come for that to happen.

Now that new technologies in telematics and environmentally friendly solutions are adding costs to the cost of developing and producing new equipment, perhaps the realisation that TCO counts for more than point of sale pricing has stuck.

In conclusion; while the Covid-19 pandemic is far from over and seems as unpredictable in its spread as ever, the confidence within the access sector remains strong, as borne out by this survey. And that positive view for the next year is shared globally - looking at the regional breakdown, growth is generally expected in all regions.

When companies were first invited to take part in this survey, the new Omicron variant had yet to be detected. Whether this will have an effect on the industry that is not apparent from the forecasts in this survey, we will have to wait and see. AI

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM