Read this article in French German Italian Portuguese Spanish

Four charts that show why rental firms are reining in spending

20 June 2025

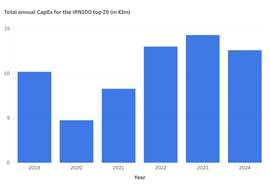

New figures from the IRN100 show that rental firms around the world reduced their annual equipment budgets in 2024 by a total of 11% compared with the previous year. Lewis Tyler looks at four graphs which demonstrate what is happening.

Construction equipment rental companies around the world reined in their spending by more than a tenth last year as a slowing global economy and political uncertainty encouraged caution.

CapEx for the top 25 rental firms slumped by 11% in 2024 compared with the previous year

CapEx for the top 25 rental firms slumped by 11% in 2024 compared with the previous year

According to the International Rental News IRN100 annual survey of the world’s biggest construction equipment rental firms, the amount of money firms spent on capital expenditure - which for rental firms primarily refers to fleet investments - fell for the first time since the pandemic.

Capital expenditure across the top 25 highest spending rental companies in 2024 stood at €12.6 billion (US$14.8 billion) - a fall of 11% on the previous year when those companies invested a record €14.3 billion (US$16.8 billion) on new plant.

According to the IRN100 which tracks the turnover figures for the world’s top 100 rental firms around the globe and which was published in full in International Rental News last week, the slump is the first time fleet spend has declined since 2020 when restrictions put in place during the pandemic led rental firms to slash CapEx by 53%.

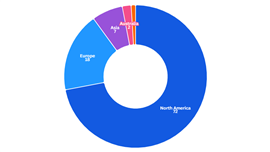

2024 CapEx from the top 25 firms in the IRN 100 by region

2024 CapEx from the top 25 firms in the IRN 100 by region

The figures indicate that rental companies are taking a more cautious investment approach amid uncertainty in equipment pricing, interest rates and demand forecasts.

They mirror findings from the T30, a list put together by IRN‘s sister title Access, Lift & Handlers, which found that the telehandler fleets owned by rental companies in North America last year grew by the lowest levels seen since the pandemic.

They also track wider forecasts made by the main rental associations of Europe and North America. In May the American Rental Association (ARA) projected that revenue growth in the sector would slow to 4.2% in 2025 and then to 3.2% in 2026 and 2.9% in 2027.

“There’s a lot of uncertainty out there which is triggering a lot of wait and see,” Scott Hazelton, managing director at S&P Global, the international forecasting firm that compiles data and analysis for the ARA said.

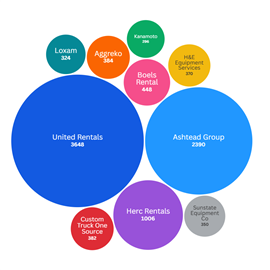

2024 CapEx by company

2024 CapEx by company

Similarly, forecasts by the European Rental Association’s consultant, KPMG, at the ERA’s annual convention in Dublin predict that many of Europe’s major rental markets will have to wait until 2026 before seeing a significant improvement in market conditions.

Overall, North American firms continue to account for the majority of spending of the top 25, making up 72% of the total and dwarfing spending by firms from all other regions. European firms in the top 25

The world’s largest rental firm, United Rentals remained by far the biggest spender in 2024 with a CapEx of €3.65 billion (US$4.2bn). It was followed by Sunbelt owner Ashtead which spent €2.39 billion (US$2.78bn) and Herc Rentals which last year spent €1 billion (US$1.16bn). By contrast the top European spender, Boels Rental invested €448 million (US$520.9 million). UK-headquartered Aggreko, which was the second highest European spender, forked out €384 million (US$450 million) on new equipment last year.

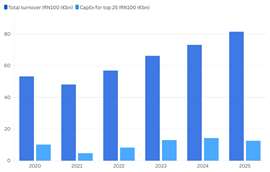

Nonetheless, despite a fall in business confidence over the past year, it is worth noting that spending remains at historically high levels.

With many firms having invested heavily in fleet in the years immediately after the pandemic when the supply chain crisis and spiralling energy costs sent equipment prices soaring, a reining in on spending is something to have been expected. IRN100 figures show that CapEx as a proportion of total turnover remains higher than before the pandemic.

Note: Figures show the top 25 investors, not necessarily the investment of the largest 25 rental firms.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM