Up and down: AccessM20 ranking reveals access sector slowdown amid macroeconomic headwinds

11 July 2025

After five years of rapid growth, the global access last year showed signs of slowing down. Figures from the latest M20 report show turnover for the world’s largest access manufacturers grew by less than 2% last year to stand at US$14.9 billion. Euan Youdale finds out why.

Image: Dall E 3

Image: Dall E 3

Turnover for the world’s largest access manufacturers grew by less than 2% in 2024, down from 21.6% the previous year as a convergence of macroeconomic challenges curbed momentum in what had been a rapidly growing market.

Weakening industrial activity across Europe and China, as well as a cooling in the North American rental segment meant that the combined turnover for the world’s 15 largest access manufacturers in 2024 stood at US$14.9 billion, up from US$14.6 billion a year earlier.

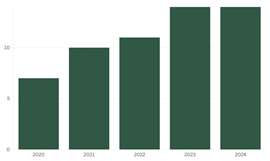

The slowdown follows five years of rapid growth in the wake of the Covid pandemic when total turnover for the top 15 grew from US$7.15 billion in 2020.

Total turnover for the 15 largest access manufacturers 2020-2024

Total turnover for the 15 largest access manufacturers 2020-2024

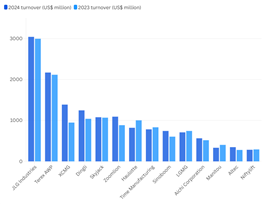

The sector’s two dominant players, US-based JLG and Genie, retained their top positions but posted markedly lower growth figures than previous years.

JLG recorded a modest 1.5 per cent revenue increase in 2024, a stark contrast to the 25 per cent rise the previous year. Genie followed a similar trajectory, with growth slowing from 18 per cent to 2.5 per cent year-on-year. The slowdown was broadly mirrored across other producers of self-propelled equipment.

Chinese manufacturers, which in recent years have aggressively expanded their global footprint, were not immune to the downturn. A sluggish domestic construction sector, compounded by intense local competition and geopolitical trade frictions, weighed on performance.

Chinese firms not immune

Turnover at China’s largest access manufacturer, XCMG fell 7.5% compared with a year earlier to US$1.39 billion in 2024 while at LGMG it fell 4.6% to US$710 million.

2024 and 2023 turnover by company. Created using Flourish

2024 and 2023 turnover by company. Created using Flourish

Nonetheless, the Chinese cohort did not perform uniformly. Some firms managed to temporarily offset the impact of looming EU tariffs—imposed in early 2025 as part of an anti-dumping investigation into Chinese-manufactured mobile elevating work platforms (MEWPs)—by front-loading exports into the European market. These advance shipments are visible in the 2024 revenue figures of several firms.

Turnover at Dingli rose 19.8% in 2024 compared with the previous year to US$1.2 billion and at Zoomlion it increased 23.4% to US$1.09 billion.

Outside the mass-produced scissor and boom lift categories, niche equipment segments also experienced headwinds.

Manufacturers of spider lifts, truck mounts, and other specialist platforms—often used in utilities and maintenance, less exposed to the vicissitudes of construction cycles—still struggled to compensate for the broader market contraction.

Bucking the trend

Yet, amid the prevailing softness, a number of companies bucked the trend. Japanese OEM Tadano, for example, posted a striking 37.5% year-on-year increase. Despite a softening domestic market, the group benefited from international expansion and strategic portfolio diversification, including its 2023 acquisition of crawler boom lift specialist Nagano.

Similarly, French vehicle-mount producer Klubb delivered strong top-line growth, driven by expansion into Latin America and the integration of Titan Aero and the Isoli Recovery range. In the upper tier of the AccessM20 table, Altec incorporated revenues from its newly acquired German spider lift subsidiary—formerly owned by China’s Dingli—bolstering its position.

Turnover by corporate country of origin in 2024 and 2023. Created using Flourish

Turnover by corporate country of origin in 2024 and 2023. Created using Flourish

The figures also show that while US based manufacturers accounted for around 42% of the total market by turnover in both 2023 and 2024, the proportion attributable to Chinese manufacturers increased slightly from 32.8% in 2023 to 34.9% in 2024.

At the same time, the share of total turnover from Canadian manufacturer Skyjack fell from 9.7% in 2024 to 7.3% in 2024.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM