Generac CEO talks acquisitions, software, microgrids and record sales

03 June 2022

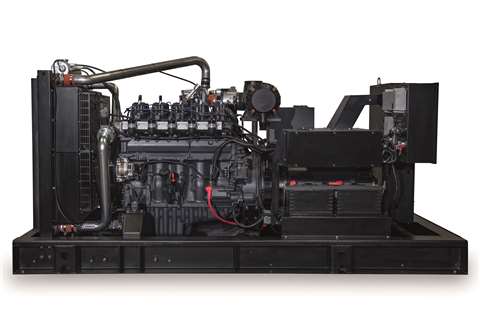

Generac’s Modular Power Systems (MPS) are generators which the company said are compact for rooftop or parking garage installations and help take the complexity out of paralleling total power generators. (Photo: Generac)

Generac’s Modular Power Systems (MPS) are generators which the company said are compact for rooftop or parking garage installations and help take the complexity out of paralleling total power generators. (Photo: Generac)

In February, Generac Holdings, the Waukesha, Wis.-based designer and manufacturer of energy technology and other power products, reported record sales in its full-year 2021 results:

- Net sales increased 50% to $3.74 billion during 2021 as compared to $2.49 billion in 2020. Core sales growth, which excludes the impact of acquisitions and foreign currency, increased approximately 46%.

- Residential product sales increased 58% to $2.46 billion as compared to $1.56 billion last year.

- Commercial & Industrial product sales grew 42% to $1 billion as compared to $702 million in the prior year.

Long known for its line of portable generators and for the automatic home standby gen-sets it introduced in 1989, in the past decade the company has successfully supplemented that business through the expansion of its energy technology solutions portfolio and the global demand for its Commercial & Industrial power generation products.

“We are making important progress on Generac’s evolution into an energy technology solutions company as we completed several strategic acquisitions during the year and introduced a number of innovative technologies that will significantly expand our addressable markets,” said Generac President and CEO Aaron Jagdfeld in a statement when the company’s most recent financial results were reported.

Generac CEO Aaron Jagdfeld

Generac CEO Aaron Jagdfeld

Jagdfeld joined Generac’s finance department in 1994 and became its Chief Financial Officer in 2002. A few years later he was appointed president with responsibility for sales, marketing, engineering and product development. He became president and Chief Executive Officer in September 2008.

In recent years, the company has kept the Mergers & Acquisitions reporters at local media outlets and national trade journals busy – it acquired Deep Sea Electronics in mid-2021, for example, and Mean Green Products LLC in September 2020 – and it also announced a wide range of new products and an ever-expanding corporate footprint. Last year, it opened a new manufacturing, assembly and distribution operation in Trenton, S.C., and purchased an existing office building just north of its headquarters for 300 additional employees. The Generac sign is now affixed to the 75000 sq. ft. office building in Pewaukee, Wis., and looks out on a busy interstate.

In this interview, Jagdfeld discusses the company’s record growth, the roles technology such as microgrids and zero-carbon power sources will play in the global power industry and within Generac, and exactly what subsidiaries such as Grid Services and DR Power mean to the company’s overall strategy.

Generac is described as a “leading energy technology company.” What does that mean to your customers? And to Generac?

That statement talks about what Generac does really well. It’s based on our knowledge of home energy systems, including the codes and standards that go with homes, our knowledge of the electronics that go into devices and the wonderful distribution channels we’ve developed over the years. It also extends our brand beyond what the legacy Generac was all about, which was really focused almost solely on resiliency. It was basically only about when the power went out. The company prided itself on making a solution for that, whether it be a portable generator or a standby generator. That was our bread and butter for many years.

Our “energy technology” approach is our way of acknowledging that we can leverage the other great things that we do – in addition to resiliency – and start focusing on the energy ecosystem within the home. To us, that’s everything from backing up the utility to helping homeowners generate their own power with our PV [photovoltaic] inverter products and store their own power with our battery products. And now they can manage their consumption with our load management products. They can manage the amount of energy they consume through their HVAC system thanks to our ecobee thermostat acquisition. We’re putting all of this technology together to help people become more self-sufficient when it comes to power and also make them more educated about the energy they use. We’re tapping into a much broader set of trends that are out there around the changing energy and utility landscape.

When the Generac Grid Services subsidiary was formed in 2021, it was said to be a “significant step toward our strategic evolution into an energy technology and services company.” In what ways will this business unit help transform Generac?

Not only do we want to focus on becoming an energy technology company in the sense that we help homeowners and business owners with resiliency, savings and conservation, on the flip side, there’s a lot of value in the assets that homeowners and business owners are acquiring to be resilient, whether that’s a generator or a battery storage device.

At the same time, grid operators and utility companies are going through a massive change. In the past, they could satisfy additional demand by building another coal- or natural gas-fired power plant, but those days are gone. The way utility companies and grid operators increase supply today is through the addition of renewable sources, such as wind and solar, which is great. The cost of those technologies on a utility scale has come down to be comparable with the previous generation of coal and natural gas plants, but the big difference – and it’s an important difference – is that those renewable sources are intermittent. They’re not continuous like the base load power sources were before.

Traditional wires-and-poles infrastructure carries the risk of transmission-sparked wildfires, which is a major concern in California and especially in remote communities such as Briceburg. The solution was a hybrid renewable standalone power system using an integrated solar, battery and generator, which addresses the wildfire concerns, but also increased grid resilience and reduced greenhouse gas emissions. (Photo: Generac)

Traditional wires-and-poles infrastructure carries the risk of transmission-sparked wildfires, which is a major concern in California and especially in remote communities such as Briceburg. The solution was a hybrid renewable standalone power system using an integrated solar, battery and generator, which addresses the wildfire concerns, but also increased grid resilience and reduced greenhouse gas emissions. (Photo: Generac)

What Grid Services is all about is helping utilities manage the intermittency of the supply and the growing power demand when they are unable to add huge new assets. We want to allow them to harness the power of all these distributed assets that are already out there or that could be added in the future.

They can harness the generators and storage devices almost in virtual format. Instead of going out and spending $100 million on a gas fired peaker plant, they can incentivize homeowners and business owners to contribute to or allow those assets to be used by the utility during limited peak times when supply and demand is imbalanced and the grid becomes unstable. That’s what Grid Service is all about.

We acquired Enbala Power Networks back in October of 2020 and they develop the software to allow for the formation of these virtual power plants and the operation of them by utilities. When we combine the Enbala software with our hard assets and make them available in aggregate to utility and grid operators, while allowing the owners of those assets to be compensated for their use, it’s really a win-win for everybody.

Is Grid Services the first time Generac has worked directly with utility companies?

It’s really the second time. If you go back about 20-plus years, we developed our DG series of distributed power generation products. We initially had 50 kW blocks of power in the form of a commercial and industrial-grade natural gas gen-set that could be installed at a fast-food restaurant or a small retail store with the idea that you could expose that generator to the utility or grid operator to be used for grid stability purposes. Then, the owner-operator of the gen-set would not only get the power reliability that they wanted, but actually get an ROI on the gen-set.

The approach was similar to today’s Grid Services but we approached it solely from a product standpoint. The generator control technology wasn’t as sophisticated as it is today and we didn’t have the Enbala software layer, but we were selling those generators directly to utilities who were in turn then convincing their rate-paying commercial and industrial customers to add the products so the utility could use them in a distributed fashion.

Ultimately, that didn’t work the way we wanted. Natural gas prices came up and utility rates stayed low. The “spark spread” as it’s known – the cost at which you can produce power onsite versus buying it on the retail market – just didn’t widen to the point where it made sense. What we’re seeing now is because the utility companies are not able to add base load power in the format that they’re used to, such as a continuous base load from a 24/7 coal-fired peaker plant, the assets are much more valuable today than they were back then. Now there is an existential threat to the overall reliability of the grid if they can’t figure out how to balance supply and demand.

And now the software exists to help them solve those challenges.

That’s what’s really changed. The technology continues to evolve. The software has gotten to a point where it can help utilities harness the power of those assets more efficiently, more effectively and really to the greater benefit of balancing supply and demand on the grid. The technology is really what’s advanced.

Generac recently reported record sales in 2021 in its Residential and Commercial & Industrial product segments. To what factors do you attribute the impressive net sales increase of 50%?

When you unpack that growth rate, when you look at what happened over the last few years, and with 2021 being an unbelievably huge year for us, it really comes from a couple of things. When you look at the Residential side of our business, there’s two areas to focus on. The first is the legacy home standby generator business, which continues to grow at a fantastic rate.

On the back of the pandemic, homeowners are doing everything from home. We’re working from home offices, kids are doing virtual learning and we’re entertaining at home. We’re shopping from home, exercising from home – look at Peloton and all of the other work-from-home plays as they call it in the stock market. The pandemic put a big spotlight on the importance of having a reliable and resilient source of electric power for the home.

When the grid goes down – and Mother Nature has delivered some pretty significant blows over the last three or four years – you’ve got all of these large-scale events that are making people more aware of the importance of electrical power. And then you overlay the bigger trends that have come out of the pandemic and that’s a big part of what’s driving growth in the portable and home standby generator categories.

Generac recently added the new gaseous CG125 - 150 KWe prime generator to its product lineup. The unit uses a new 9.3 L engine that the company said was designed for better fuel consumption while providing extended maintenance service intervals compared to leading competitors. (Photo: Generac)

Generac recently added the new gaseous CG125 - 150 KWe prime generator to its product lineup. The unit uses a new 9.3 L engine that the company said was designed for better fuel consumption while providing extended maintenance service intervals compared to leading competitors. (Photo: Generac)

On top of that, in the residential market, we’ve got our clean energy products such as the new battery storage systems, our power and load management products, and our Grid Services products. We’re seeing amazing growth there. That particular part of our business doubled last year. There are amazing opportunities for us to continue to grow that, again by tying into some of these bigger trends around the grid, with it becoming more decentralized, digitized and more decarbonized.

We see a future where it’s not going to be rare to see a solar system on a home with a battery and some additional load management devices that you control with a cell phone in the palm of your hand. That’s going to be more of the norm going forward, and those are the types of products we’re selling in clean energy.

In our Commercial & Industrial business, our telecommunications customers in particular are also quite concerned about resiliency as they continue to build out their networks. As they move to 5G technology, they’ve got to harden their networks to a different degree than the previous generation of technology. To do that, they’re buying a lot more generators as a result. That’s another area of the business that is really seeing some explosive growth.

The Commercial & Industrial side of our business grew just as fast as the Residential side in the last couple of quarters at Generac. We see it as an important part of our overall strategy of being an increasingly important player in the overall energy technology landscape. That includes homeowners as well as business or commercial owners. When you think about energy technology, we don’t want to just pigeonhole ourselves into the residential market.

We want to think more broadly about how we can supply the new technologies in this new brave world we’re headed into with a decentralized, digitized and decarbonized grid. As that takes shape, commercial and industrial users are obviously big consumers of power. So, having a robust and healthy Commercial & Industrial business for us is really important.

It’s well known that bad weather can help convince consumers to install a backup gen-set for their homes. Are there other factors at play in 2022? In what ways is the Commercial & Industrial segment different?

First of all, when you get a weather event such as a hurricane or the Texas freeze that happened last February, homeowners tend to react much more quickly than the Commercial & Industrial customers. In the immediate aftermath, homeowners are looking for solutions. They don’t want to be in the dark ever again and they can make that emotional decision to buy a generator or other resiliency device quickly.

Businesses tend to follow six months to a year later because they have to plan for it. There’s a budget cycle. They have to show their business leaders that there’s a return on the investment. For many companies, a single lost hour of operation can add up quickly. Traditionally, what we see after these types of events is the Residential business lights up fast, and then the Commercial & Industrial market tends to follow.

We are seeing some of that now as a result of the hurricane activity and the 2021 Texas freeze, but it goes a step further. In the Commercial & Industrial world, the Grid Services opportunity has also become really interesting. Utility companies are very interested in the larger blocks of load that come with backing an Amazon distribution center or a wastewater treatment plant. They see those 500 kW or 1 or 2 MW blocks of power as an opportunity – it takes a lot of individual homes to add up to that much power. If those business owners will allow those gen-sets to be enrolled in a Grid Services program, the utilities and grid operators are willing to pay good money for that access.

Businesses are coming to the realization that they were going to buy a generator anyway because of the ROI that comes along with protecting their operations. Now the Grid Services opportunity basically supercharges the ROI of that gen-set.

Generac has significantly expanded its manufacturing and office footprint, which makes hiring and retaining good employees even more important. As the company grows, what have you found works best?

This part of business has been challenging and I think all of your readers would share the same sentiments. Here in Wisconsin, we’re in the low single digits with the state’s unemployment rate and that makes finding people really challenging. I think for Generac we have the benefit, first of all, of being in growth mode. If you’re looking for a job, the opportunity to work for an employer that is growing versus one that’s maybe in an industry that’s declining, you’re going to benefit from having a little more peace of mind about the stability of the company you’re working for.

Another thing that we’ve found in the people who are interested in coming to work at Generac is they understand that growth creates even more opportunities. You can get your foot in the door here in a certain role or at a certain level, and because of the overall growth of Generac, you can quickly grow your own professional career if you choose to do so. We offer people the opportunity to do some really cool things that might not otherwise be available to them if they were in companies that weren’t growing quite as fast or in industries that aren’t quite as growth oriented like energy technology.

You also have to offer compensation packages that have a good upside, whether that’s through stock options or other equity instruments, to help incentivize teams. As we grow and as we’re having such good success, we’re paying a lot of bonuses. So, the overall comp package is quite compelling for people — and that’s obviously an important focus for anyone in the market for a new job.

It sounds like Generac’s positive annual reports are as good news for the investors as they are for the company’s human resources department.

Yes – that’s exactly right. They end up being a victory lap for everybody. It’s the employees, it’s customers, suppliers, investors – we’ve all benefited from the success that the team has had here and that the industry’s had overall. And I think that speaks volumes to, again, being a company that has the right approach to this market, but also being in the right place at the right time.

What are your plans for outside of North America?

Today, a little more than 10% of our sales are outside the U.S. and Canada. We have a really nice growing business in Europe with a couple of companies we acquired in Italy and we’ve got facilities in Spain and another company in Germany. We’ve got a couple of companies in the UK that we’ve added over the past several years and that’s also given us exposure to international markets.

A lot of the mega trends with utilities and grid operators, as well as the changing nature of the grid, are happening around the world. It’s a global phenomenon. We definitely want to make sure that we’re not myopic in our approach to just thinking about the U.S. and Canada. This is really a global opportunity.

Generac has invested in clean energy technologies, but the bulk of the generator products are engine powered. In a world where regulations are essentially trying to force society away from internal combustion engines, how much does that concern you?

The internal combustion engine is fantastic technology that has come a long way in 100 years. That technology has been continually refined and improved. It’s a really cost-efficient way to produce power onsite. That being said, it is our belief that the internal combustion engine is in its sunset years in terms of its future and that impacts the investment level in the technology itself. Our industry tends to follow the trends in automotive. So, as you look at the automobile industry, there’s a lot of investment going on toward the electrification of transportation. And that is basically a reallocation of resources. Instead of developing new internal combustion engine platforms, those R&D dollars are going into developing electrified platforms and more efficient motors and regenerative braking systems and the battery systems themselves.

When we think about the future, we think alternative, less carbon-intense forms of power are certainly going to play a role. And there are a number of other technologies that could replace the internal combustion engine – perhaps technologies like fuel cells.

One of the big distinctions – and it’s an important distinction – is that batteries don’t generate power, they store power. You still have to generate electricity from something. Batteries are a storage system. In the parlance of the internal combustion engine world, the battery is the gas tank. You’re storing all that energy in the gas tank, but you still need something that’s your prime mover. You still need something to generate power.

Our belief is that renewable generating sources like solar and wind are the things that can help create the energy that gets stored, especially as their costs come down, but we’re still a ways off from that. Even though we’re in what I would say is the sunset years of the internal combustion engine, there are a lot of years left. We’re talking decades.

What role do you see microgrids playing for Generac and for power generation in general?

A microgrid in a Commercial & Industrial situation might be a university or a hospital campus. Usually, you want to find applications where you’ve got multiple facilities gathered close together. The ability to create a microgrid for those facilities by generating power onsite, and then distributing that power to that small campus of facilities is coming on strong. A lot of that is driven by resiliency, because when a microgrid is not dependent on the local utility but is instead dependent on its own generating sources and storage, they will have more autonomy.

Built in Ross, Ohio, the battery-electric Evo is the flagship of Mean Green Mower’s Evolution Commercial ZTR Series. DR Power Equipment, a division of Generac Holdings, acquired the assets of Mean Green Products LLC in September 2020. (Photo: Generac)

Built in Ross, Ohio, the battery-electric Evo is the flagship of Mean Green Mower’s Evolution Commercial ZTR Series. DR Power Equipment, a division of Generac Holdings, acquired the assets of Mean Green Products LLC in September 2020. (Photo: Generac)

We acquired Deep Sea Electronics, which is a generator controls company based in the UK. The company is fantastic by the way — the team there is great. And they are very well-known in the generator industry, where they have been advancing generator controls as well as microgrid controllers. So, we are very excited about what their technology brings to our efforts around microgrids.

Think of it this way: A generator is a component in the microgrid. So, you are going to need a controller at that gen-set and you also need a controller at the top that operates all of the different assets that make up the microgrid. Whether that’s a combination of engine-driven gen-sets and batteries or solar, the technology to control all of it is far beyond controlling a single asset. It’s controlling the assets, integrating and synchronizing them so they operate as an independent grid. Much like the larger grids that are all around us, they must keep supply and demand in balance. That’s what the microgrid controller does.

The Deep Sea acquisition brought us a fairly complex set of technologies around microgrid controls that, in concert with our natural gas gen-sets and our storage products, will put us in a really interesting position as the grid continues to change and microgrids become more popular. We think we are quite well positioned to participate in that.

Generac has made several interesting acquisitions over the past decade. Looking at the portfolio today, do you consider one in particular to be the keystone for the future of Generac?

We’ve made more than two dozen acquisitions over the last 11 years. It would be difficult for me to say there’s any one acquisition that I could point to as key. But I would talk about the more recent acquisitions that have focused on some of the newer technologies, whether they be battery storage or thermostatic controls, or the PV micro inverter company that we acquired in California called Chilicon Power, which we did last summer. There’s also Deep Sea, which we just talked about, and last year there was another company in the UK called Off Grid Energy, which does energy storage for the commercial and industrial rental markets.

All of the acquisitions build on each other. The strategy with acquisitions is you’re either acquiring a technology or perhaps an access to a channel like we bought with Magnum – which gave us access to the rental channel — or maybe you’re buying a brand-new product line.

Magnum [Generac acquired Magnum Products in 2011] gave us an entry into the rental markets. It wouldn’t have made a lot of sense for us to acquire the Off Grid Energy company [in September 2021], which sells battery storage to the rental markets, if we didn’t already have good relationships there to leverage.

Sometimes, an acquisition has more to do with talent. We did an acquisition last year of a company by the name of Apricity Code Corp., which is a software development shop in Bend, Ore. We needed to hire developers and its team of engineers have joined Generac.

Whether you’re going after a technology or a product or people or market access, all of these acquisitions have to fit the strategy. And our strategy is all about becoming an energy technology company. And that’s where the more recent acquisitions are building on the acquisitions from years ago, so it all works together.

DR Power joined the Generac family in 2015. Where does this subsidiary, which is known for its line of outdoor power equipment, fit within the Generac of 2022?

DR Power is interesting. This is a good example of something we did several years ago as an acquisition where strategically we were interested in several things. We felt there were some decent synergies in the machines that DR built. They’re primarily engine powered. We have a great supply chain around engines and we have a lot of design capabilities around engine-powered applications.

DR’s channels to market were also interesting. They were primarily a catalog and online direct-to-consumer company. You can go to DRPower.com and you can buy a log splitter or a walk-behind mower or a brush cutter and they will ship it to your house.

They were also selling a lot of that same equipment into the hardware and farm and ranch channels. We felt there was an opportunity to take what Generac sold and get it in front of those same customers, and we could introduce DR Power to new customers through our existing relationships. We’ve been able to grow their B2B business, and at the same time, we’ve been able to put some of our products into their direct-to-consumer business.

DR Power Equipment joined the Generac family in 2015. It recently introduced the XD30 commercial field and brush mower with a 30-in. cut, powered by a Kawasaki gasoline engine rated at 18.5 hp connected to a hydrostatic drive. (Photo: Generac)

DR Power Equipment joined the Generac family in 2015. It recently introduced the XD30 commercial field and brush mower with a 30-in. cut, powered by a Kawasaki gasoline engine rated at 18.5 hp connected to a hydrostatic drive. (Photo: Generac)

And then, wrapped around all of this, are the broader trends in electrification. As engines get replaced by battery power, we’re able to take the technologies we’ve been investing in around battery storage and leverage that to the DR Power business as it goes through the electrification process.

In 2020, we acquired a company called Mean Green Mowers that now sits inside the DR Power business. Mean Green is a battery-powered zero-turn mower company, which is awesome. It is a great product. It’s really high end and focused on the commercial cutting markets, but it’s a good example of where we take the battery technology within Mean Green, combine it with our own battery storage technologies, and get some scale on the supply chain side. We’re taking those battery platforms and moving them into core DR Products like brush cutters and chippers, shredders and tillers. These bigger products have been harder to switch to batteries because the engine is harder to replace on heavy-duty applications. But we’re using our knowledge in the heavier duty battery applications from Mean Green and our own storage products.

DR Power’s primary customers have a couple of acres of property and tend to be pretty independent. So, there’s actually some crossover with the buyers of brush cutters and the people who want a home standby generator. They want that self-sufficiency and independence. We think DR Power fits really well with what we’re doing here and it gives us exposure to the direct-to-consumer markets.

And we love the company. It’s got a cool vibe. They’re headquartered in Vermont, and we build the products in Jefferson, Wis.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM